LIDAR Magazine was fortunate to be invited to the facility of Ouster, Inc., in downtown San Francisco, for a factory tour and an interview with co-founder and CEO Angus Pacala. The visit was organized by Heather Shapiro, director of communications, and my host Tom Grey, director of product marketing. The premises were a contrast to the modern, rectangular, one- or two-floor buildings of, for example, Cepton Technologies and Quanergy Systems, which the magazine has also visited. Formerly used as a tee-shirt factory, the facility seemed labyrinthine, with multiple large and small spaces, numerous staircases and the need to cross a courtyard to walk from one part of the facility to another. Yet it seemed a captivating home for Ouster, a vivid contrast of the old and the new. I met Angus at his desk, in an open plan area. He seemed to have the same desk and floor space as any other employee, with one exception. Behind his chair was a cuboid structure, like a closet or telephone booth, to which he retreated when he needed quiet or to make important calls. We did not attempt to share it for the interview but went to a conference room.

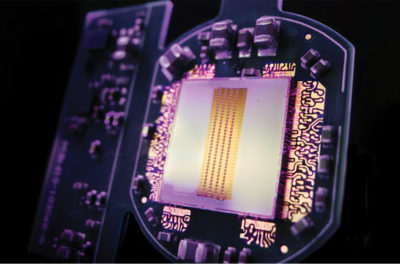

Ouster released the L2X digital lidar chip in October 2021, the most powerful, highest performing chip Ouster has ever designed and it powers all of Ouster’s latest Rev 06 OS series scanning sensors. Capable of counting up to 1 trillion photons per second, and outputting up to 5.2 million points per second, the L2X system-on-chip (SoC) continues Ouster’s journey along the Moore’s Law curve by doubling the maximum data rate of its sensors. The L2X handles all the logic and signal processing on the sensor and can process both the strongest and second strongest returns of light for each pixel.

LM: Thank you so much, Angus, for agreeing to talk to the magazine. You’re another Stanford guy! You began with four people in 2015? I’ve visited Quanergy Systems as well, and your name is on one of the patents on their wall.

AP: Yes, I was a co-founder of Quanergy. I was director of engineering there for two and a half years, all the way back to 2012. So I co-founded Quanergy in November 2012 with Louay1 and Tianyue2. Mark Frichtl, my co-founder here, is a Stanford classmate. Mark and I were friends back in 2012 and he was the first or second employee at Quanergy. We worked on their early M8 system.

LM: But you must have left Quanergy when you and Mark said, “We have an idea. It’s really special. And it’s better than what we’re working on here.”

AP: We disagreed with Quanergy’s business strategy and technology approach. A number of employees left around that time. Mark took a job with Apple and I took some time off. Eventually, we both naturally gravitated back towards discussions around lidar. What could we do next? That was where, when we were able to step back clear-eyed, we asked, how can we align? How can we apply digital technology to lidar for the very first time, truly apply it, not in some small form, but do what Silicon Valley has done for 60 years, put lidar on a chip? It truly had to be digital. That seemed like the obvious way to win the industry long-term. We had some breakthroughs in ideas and decided midway through 2015 to found the company around them.

Ouster optics module, the tiny assembly at the heart of its sensors and one of the firm’s key differentiators.

LM: Congratulations. Look what you’ve done.

AP: Yes, it was the right decision.

LM:You have 200 people now?

AP: I think we have 200 or 210 people3.

LM: That’s huge. I think probably only Velodyne Lidar is in that ballpark.

AP: Of the public companies, Velodyne is maybe double us. It’s interesting, because, of the companies that have reached any kind of commercial scale, we’re the smallest by far. Velodyne is almost double the people. I think Hesai out of China is almost double the people. Actually, Luminar is around 500 people, so they’re way bigger. And yet, we’re doing a lot with a little.

LM: A more whimsical question. You’ve got a couple of dictionary-like definitions of Ouster on your website4—are they real?

Ouster OS sensor portfolio: from left to right, OS0 ultra-wide view, OS1 mid-range, and OS2 long-range.

AP: Yes. The Ousters are from the sci-fi book Hyperion by Dan Simmons. They’re humans who have embraced technology for the betterment of humanity.

LM: It’s quite hard to understand the differences between lidar companies because they’ve all got hardware, they’ve all got firmware, they’ve all got some software. But how far do you go? And there are other companies like DeepRoute that don’t make sensors at all—they integrate other people’s.

AP: It’s really hard to make sense of this industry! I think of it as three pillars. We have our digital lidar technology, which is really, really different than the rest of the pack. We’re putting lidar on to a silicon chip, as a digital lidar module. And it’s a super simple device. Compared to the analog or complex lidar sensors, this is simple. It’s a silicon chip on one side, if you look through the lens, and all these arrays on the other. That’s it.

LM: Whereas the M8 is still a spinning device?

AP: Not just that, there’s hundreds of components in the domain, for the receiver, for the laser side. And so we’re replacing all that with a single custom chip.

LM: The top end of your range is 240 meters—you get 240 meters from that?

AP: You can get kind of an arbitrary range from the digital technology: it’s just how much power you want to pump into the system. It’s super performant, cost-reduced and small. That’s the benefit of digital technology. It’s the same, you know, with the cameras in the iPhone. It’s the march of CMOS technology.

LM: When I was getting into land surveying, electronic distance measuring had just been invented. So you had a big box of tricks on a tripod and, at the end of the 70s, a device like that would measure about three kilometers to an array of glass prisms at the other end of the line on another tripod. All to measure one point!

AP: These devices do 2.6 million points per second. That’s just amazing.

LM: I liked the Founders’ Vision video on YouTube5 that you did, “to make lidar affordable and ubiquitous”. And obviously, I agree with that and admire it. But aren’t your competitors all trying to do exactly the same?

Ouster product line on exhibit. In the foreground is the OS2 lidar sensor, which delivers long-range, high-resolution 3D sensing for commercial deployment.

AP: I don’t think so, for maybe a couple of reasons. The first is, I just don’t think they have the technology to do it. The ubiquitous technology is digital technology: you pull apart a phone, you pull apart a car, the technology inside is CMOS digital semiconductors, it’s not anything else. It’s really remarkable that it’s only CMOS digital semiconductors. And it’s single-chip solutions. Everything gets condensed on to a chip, whether it’s a camera, whether it’s an inertial measurement unit or a cell modem, it goes from discrete components to single chips. Lidar is going in that direction. In order to make things ubiquitous, you really have to go towards these hyper-affordable, hyper-performance, small-form-factor devices. You can make one-off analog devices that work great for a single application, like a car. But you can’t make something that’s a platform of products that goes on a rover on Mars and goes in your cell phone and goes on a car. That’s what we’re trying to do. In combination with that, our strategy has always been a diversification across industries. That’s the real thing—like the rubber meets the road. Everything we communicate about our company is about ubiquity across verticals, smart infrastructure, industrials, robotics and automotive. That’s not something that our competitors are doing. That’s why I think we can do the ubiquity side and no-one else.

LM: There’s a good quote from you, in an interview with IPO Edge on 16 March 20216, about the total addressable market being $8.6 billion by 2025 and $48 billion by 2030. But isn’t it more difficult to address than the automotive market in terms of your sales structure, expertise and so on?

AP: What’s so funny about technologists is that they only want to solve the hard technical problem. Isn’t it hard to build lidar technology? Why are they okay with solving the hard technical problem, but not the hard business problem? So yes, it’s hard to build a company that serves four different markets with different needs and different customer purchasing cycles and requirements. But if you do that, then you become an Nvidia or a Cisco or a Qualcomm or a Broadcom, that’s the whole point. I really care that execution, proof through execution, across the business is not about being a great technologist, it’s about trusting people who are good at things other than technology. I put a lot of trust in our VP of operations, Darien Spencer, and our president of field operations, Nathan Dickerman, basically our sales lead, and all these other people who know something fundamentally different than me with a Stanford engineering degree. And the proof is in the fact that we ship more sensors and have a higher revenue than the majority of public lidar companies combined. And we do it with industry-leading positive gross margins. We have a dual manufacturing strategy, so we also produce here. We build and ship from a facility in Thailand. I’ll get off my soapbox!

LM: Yes, but your soapbox is interesting, because nobody else is saying exactly that. I looked at an interview on Seeking Alpha with Kevin Kennedy, the CEO of Quanergy7. He was basically saying, automotive is great, but we have to look at other verticals, because autonomous vehicles aren’t here yet. We need revenue. Right?

AP: Yes, he’s right, and then some. We’re diversified because I don’t want to be an oracle who has to perfectly anticipate how all these cutting-edge technologies are going to come to market. I don’t want to be betting our company on autonomous vehicles or autonomous drones or what have you. I want to be diversified and allow the winners to win. I have no capacity to affect when autonomous vehicles arrive. I want to be in a position to serve as many markets as possible simultaneously. So he’s right. That’s the difference with Ouster: we have doubled down on all four of those verticals. We have product market fit across all of them. We’re not saying, we’re not interested in a market, because it’s not ready now. All the markets have good potential.

LM: You’ve probably found the small geospatial market hard work for the number of units you’ve sold, because people like Jeff Fagerman at LiDAR USA are picky.

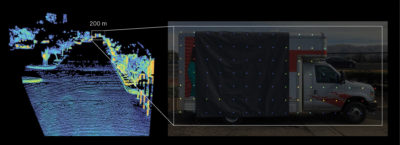

Ouster flash lidar produces high-resolution 3D data and delivers rich point density on a low-reflectivity target at 300 m.

AP: An interesting thing about digital products is that when they enter a market, there’s always a set of power users who have mature analog products that they want to keep using. Photography is a great example – film: professionals are the last to adopt digital. And that’s true of digital lidar. There’s always going to be someone who thinks, I can get better data quality, or whatever, and I’m willing to pay a tax. But digital technology, the exponential improvement rate, eventually becomes visible.

LM: If he’s happy, then it probably means he’s put the product through its paces on several drones. Probably he’s also got a system that you can take off the drone and put on the roof of a vehicle. That’s an interesting and very rapid transition.

AP: That goes to product flexibility: being best in class in size, weight, power, resolution, range, field of view, allows you to be flexible across many different use cases, because there are so many.

LM: You’ve also come up with the phrase, “At Ouster we’re building the eyes of autonomy”. On your LinkedIn page, you say, “Digital lidar for everything.” That’s great. As we say, in Scotland, you’ve “got the gift of the gab.” These excellent phrases make the point. It’s not that easy to divide the non-automotive market into clear verticals, different people probably do it in different ways. There are smart cities. There’s robotics. But you feel that you’ve got clarity on that, and are designing your sales structure to address it?

AP: We have internal clarity. I am very public about industrials, smart infrastructure, robotics, and automotive. But we don’t provide the itemized sub-verticals within each one of those four. You’re right, it’s hard, there are thousands of sub-verticals. And robotics, for instance, is a total catch-all. What does robotics even mean? So we put researchers and universities, legged robotics, 3D surveying and mapping into robotics, we even put defense into robotics for now, but that may change over time. Going back to the question, do we have a map internally, do we understand what we’re doing, yes, we look more for things like product certifications. If there are large customer sets that require a certain certification, they should be all lumped in together, for example with some sort of smart infrastructure, municipal certification. Those use cases, those customers, that smart infrastructure—there are ways to map it, and have strategies for the major sub-verticals.

LM: One of the things that I tend to ask—you’ve already touched on this—is that all these companies like yours seem to be blessed with a really talented leadership team. It’s completely obvious that you and your competitors all worked like dogs to get here. There’s no question about it. One of the interesting things—and it applies to yourself, and I think other members of your leadership team—is that there’s a certain amount of jumping, I use the term bed-hopping, I wish I hadn’t, going from one company to another. Do you feel that’s healthy? Is there any risk to IP? Is there any bitterness in the companies that you leave behind?

AP: I guess Mark and I are the canonical examples of that, given that we left Quanergy. But if you look at Ouster in general, one of the things I’m really proud of is that we’ve created a community of people here who, I think, are motivated to stay and like working here. We pulled almost nobody from competitors and we’ve lost almost no-one to competitors. If you look at the make-up of our team, there are people that have been here five or six years, a large fraction of our team. It’s really cool. We have a kind of a humble roll-up-your-sleeves attitude around here that people like.

LM: We can get on to the SPAC8. There have been so many SPACs in the lidar world. Cepton is in the middle of theirs, Quanergy’s in the middle of theirs. Velodyne was a while back, then AEye and Innoviz. Everyone’s doing it. I’m not a financial guy, but I do understand that it gives you easier access to capital, it’s probably easier to get there than chasing venture capital. My question is, if all the competitors are getting SPACs, isn’t it like all the boats bobbing in a rising tide? You’ll compete with each other on a higher plane, you’ll have hundreds of millions of spend instead of tens of millions?

AP: Is it bobbing on a higher plane? You’re right about why companies are going SPACwards because it’s an easier route to capital. It’s not because they are necessarily ready to be public companies. This is something that I get passionate about, because of all the companies that have gone public, I really think Ouster tops the list in credible business metrics. We are the only company that makes money when we sell a product. We have a positive gross margin. Actually most companies, when they go public, have a positive gross margin. They might not be EBITDA9 positive, they might not be profitable, but at least when they sell more of their product, they make more money. That’s true for Ouster and not true for most other public lidar companies, which is insane to me. We have 600 customers now. When you look at some of these other companies, they might count the number of customers on one hand. We have the second most revenue in the industry behind Velodyne. We’ve actually shipped thousands and thousands of units, which is something no other company but Velodyne has done. Last quarter, we shipped almost 1500 units. So I care about distinguishing ourselves from the rest of the pack through metrics that don’t require a PhD to understand, because the reality is, all these companies went public, and some of them maybe weren’t ready to be public, but it was just a really convenient route to equity.

LM: It makes sense, because otherwise you’re lining up on Sand Hill Road10 for 10 or 50 million at a time. Now, a more personal question. Do you spend your time at home at night worrying about the stock price? Has it changed your life?

AP: Do I think about the stock price? Yes. Do I worry about the stock price? No. In that the stock price is divorced from reality and will be for some time. I care about communicating the long-term, real business that we have built and are continuing to scale. But I spend my time talking to investors and analysts who care about the stock price. So I do have to care about the stock. That’s why you also have great people on the executive team, like our CFO. Her job is to spend a lot of time with investors. And she was a public CFO at TiVo before. I don’t know how many other lidar companies have CFOs with public company experience.

LM: There are lidar companies still without SPAC. There’s somewhere in the double digits of lidar companies around. The market is not going to support them all forever, there’s going to be shaking out. How will that be affected by SPACs? Also, I don’t know if it’s an internet rumor or fact about you acquiring Sense Photonics. Is that part of a shaking out or a consolidation in this case?

AP: On that I can’t comment. But on how this shakes out? You talked about boats rising and bobbing. I don’t know, I think a lot of them are going to capsize, but they’re going to keep floating and just kind of exist for a long period of time. They may become almost like zombie shells of companies. There’s not room for seven, or however many public companies there are today. There’s room for two, three, maybe five. But everyone’s raised a huge amount of money. Some companies will just exist in five years with ample cash and no customers, no revenue. There’s a number of private companies still, tens of them. Maybe some more will go public. I think a lot will get acquired, because it’s very difficult to raise money from a VC that sees seven or more public lidar companies with ten times the cash. So I feel for the smaller companies, it’s difficult.

LM: The last question is an obvious one. You have a tremendous amount going on. You closed the SPAC in March, it’s all go, what are your plans for the rest of 2022 and 2023?

AP: Digital lidar for everything! We have this great silicon roadmap. You know, the way we build the products is the way that all silicon companies do. You develop a new chip, you put it into your product lineup, and it gets 2x better. And then you do that again and again and again. And that’s the core of what we’re doing here while we’re expanding our manufacturing capacity, or quality or reliability of our products and scaling—again, the more we sell, the more money we make, which is not true of anyone else in the industry. Our goal is to expand sales and make more money and become a profitable business.

LM: There’s scaling, and there’s reliability and manufacturability, if that’s a word.

AP: Reliability and quality. We want to have high yields and high-quality product. That’s really important for safety-critical applications.

LM: Angus, I’ve taken enough of your time. It’s a pleasure to talk to you. Thanks for seeing me. I really appreciate it.

AP: Great, appreciate it. Enjoy the tour with Tom—another Stanford alumnus!

Factory tour

Tom explained that we had come through the main building to the area containing Angus’s desk and the conference room. He described the building as the company’s dedicated engineering R&D building. Angus and Mark were there, along with product management, finance and legal. On the floor below was “the hangar”, an R&D control facility with limited access, compulsory wearing of safety goggles etc. We saw multiple test stations and Tom explained that as a result of covid there had been some reallocation of space, a process not yet complete. There was a half-floor, an eccentricity of the older building. We saw picnic tables, barbecue and ping pong, the accoutrements perceived as necessary to attract top talent. Tom revealed that these were in fact most popular with the manufacturing team, some of whom had worked with each other for 30 years. Moreover, Darien Spencer was a dab hand at karaoke! He’s a low-key individual but had been head of manufacturing at Seagate.

We mused on why lidar attracts such remarkable people. Is it about company technology and culture combined? Whether it’s the technology itself measuring point clouds, or whether it’s the applications, lidar does attract people. Tom couldn’t quite identify the key. He ventured, “It’s a little different for everybody. On the engineering side, it’s a fun problem for a lot of engineers, because it’s rare that you find a company where the hardware and the low-level electrical engineering, the optics and the computer science all play together. There aren’t too many places where you get to do true R&D to that degree. A lot of engineers like the multidisciplinary piece of it.”

We also discussed the change from two or three years ago, when lidar suppliers offered a sensor, and maybe some kind of SDK that would let people get raw data off it and start doing things, but now they have to offer considerable software as well, sometimes called the perception layer. Tom emphasized that Ouster is investing very heavily in software, with numerous software engineers on its staff.

Just a step further Tom pointed out another differentiator. “These are manufacturing stations that do optical alignment, for sensors. But these are all custom-built in-house, and all the software inside and the mechanical six-axis motion is done in-house. So the software to run these is also custom-developed from scratch.” He perceived it as Ouster’s participation in traditional, craft aspects of manufacturing, “… designing these automated machines and writing the software to automate the mechanical alignment.” Some of the machines are shipped to the production facility in Thailand.

Tom showed me the break area where copies of LIDAR Magazine had been located, but, alas, these had perished amidst covid precautions. We had come into another building, which contains the business functions.

I was still struggling with why I had not met Ouster before, except once when I was visiting LiDAR USA in Alabama11, but Tom was reassuring, “It doesn’t surprise me. The approach to our sensors is pretty anathema to classic lidar beliefs. It requires advanced algorithms to clean [our data] up into a good map. Mapping customers are not necessarily the best fit for our sensors unless they’re looking for something that’s local, basically a quick and dirty map.” Tom readily acknowledged the noise characteristics of the Ouster sensors, but nailed the situation perspicaciously: “It’s basically due to the types of lasers we use. They’re weaker, but compact, cheaper and getting better. Our approach is making something that we know is shorter range and lower performance today, but playing into a rising tide.” While certainly interested in the geospatial world, Tom also pointed out that a better application for Ouster sensors at present is the autonomous robotic sector. We agreed that the geospatial market is small compared to Ouster’s other segments and Tom felt that it would be subject to consolidation in the same way as lidar system suppliers.

Tom shared Angus’s delight at the SPAC and felt that the process had perhaps run more smoothly for Ouster than some of its competitors.

We ended in the manufacturing facility, a room called “new product introduction”, where Ouster irons out the whole process and which Tom described as a “…fast iteration by having the engineering team just in the building next door. If there’s any problem, they can just call them over and work it out. The engineering team next door is designing the machines and the process, whereas the [manufacturing] team is implementing and scaling it. The capacity is about 2000 units a month, though it’s not yet fully scaled.” The Thailand facility, of course, has an enormously greater capacity and will be key to Ouster’s growth.

As we ended the tour, Tom was quick to reemphasize the contributions of Angus and Mark, their technical and even financial risk-taking and their sheer hard work.

Just as we parted, Tom explained that, like most companies, Ouster has more remote employees than pre-pandemic, so it will take some time to sort this out in terms of expectations, office layout and work patterns. For the moment, for example, pets are allowed!

Ouster’s 2021 results

Since the interview, Ouster has published its 2021 Q4 results. The raw numbers, staccato, italicized on the website12, were impressive, “$11.9 million in revenue in Q4, up 53% sequentially, with industry-leading 30% gross margins; record shipments of over 2400 sensors in Q4, nearly tripling year-over-year; delivers on full year 2021 guidance with $34 million of revenue and 27% gross margins”. 6475 sensors were shipped in 2021, totaling over 10,000 sensors shipped to date. The firm’s net loss decreased to $94 million, compared to $107 million in 2020, though its adjusted EBITDA loss was $67 million, compared to $36 million in 2020. To many of us, these red figures are scary, but remember that Ouster is a high-tech start-up, for which they are by no means unusual.

Angus was effusive in his formal briefing to investors, “This year was a turning point for Ouster as we scaled up our commercial engine, proved our high-volume manufacturing capabilities, accelerated our automotive roadmap, and won key customers across each of our target vertical markets. We expect 2022 to be even stronger, with important product and customer milestones that we are excited to share throughout the year. Ouster’s diversified, digital lidar strategy has taken stride. We have a clear plan to grow our business, further differentiate our product offerings, capture market share and extend our market leadership.”13

We took the opportunity, therefore, to pose a handful of additional questions to Angus. These were submitted and answered in writing. Here are his replies.

LM: Congratulations on your Q4 and full-year 2021 results. I’ve included in the article the key statistics and your words from the press release, but could you please highlight for us what gives you the greatest pleasure? Did you feel that the company fared as well as you expected in 2021, or better? Could you please explain for our readers that, despite the tremendous progress, the company has been making losses, yet these are entirely normal for a high-tech start-up at Ouster’s stage in its development? You already touched on this during the main interview, so it seems that the financial progress you are making towards profitability, however it is measured, is going according to plan.

AP: 2021 was a fantastic year for Ouster. We nearly doubled revenue with positive gross margins, built world-class commercial and auto teams, accelerated our hardware and software roadmaps, tripled our unit shipments with no breakage in supply, grew to over 600 customers, and delivered on our full-year 2021 guidance. And we accomplished all of this in the midst of a global pandemic and an unprecedented disruption in the semiconductor supply chain.

Ouster is a high-growth technology company and hardware development requires capital investment. This is completely normal in our industry, and we have a clear path to profitability. Our digital lidar technology results in a simplified architecture that makes our products inherently suited to volume manufacturing, allowing us to scale rapidly while driving down the cost of goods sold faster than our average selling price. This is why Ouster has the highest gross margin profile of our public lidar peer group, validating our company’s leading cost structure.

LM: I’m asking these questions a year after Ouster was listed on the NYSE. Are you happy with how the stock has performed in the first year? Does it feel good to be in the public eye in this way?

AP: In high-growth industries like ours, it takes significant capital to bring products to market and scale. Becoming a publicly-traded company is a great opportunity for companies like Ouster that have strong fundamentals such as product-market-fit, a growing customer base, growing revenue, positive gross margins, outsourced manufacturing, and an executable go-to-market strategy.

In the first quarter of 2020, Ouster had about a10% share of product revenue generated by our public lidar peers. By the end of 2021, Ouster’s share of product revenue had grown to nearly 40%. Over the same time period, we have closed the market share gap with the incumbent lidar company from over 60% to under 10%.

We can’t control the market trends or macroeconomic factors that impact share price. Ouster is focused on executing against our plan. We remain as confident as ever in our roadmap and market opportunity. We project to generate the highest revenue for 2022 of all public lidar companies due to ongoing and significant market share gains, along with the company’s diversification strategy, where automotive, a market not slated to ramp until 2025, is only one piece of a multi-faceted business.

LM: As we discussed before, a handful of lidar suppliers has gone through the SPAC process and as a result has been able to fund more initiatives than otherwise would have been possible. Would you say that the race to the top will be won by the contender that most effectively uses the easier access to capital? I don’t mean spend the most money most quickly, but rapidly deploy the new funds in well-designed initiatives not only in R&D but also in sales and manufacturing – or perhaps in developing foci in particular markets, whether verticals or geographies. I’m sure you wish to be discreet, but is there anything you can say about Ouster’s strategy in this respect?

AP: Not all SPACs are created equal, regardless of how much capital they raised. Some of these companies are only a few customers away from zero revenue. There are SPACs which will likely be able to exist for years as zombie companies on the cash they raised when they listed. Some of these companies are still trying to figure out how to bring their prototypes to market with volume production. Even lidar companies that have been around for over a decade haven’t realized positive gross margins yet. The right technology approach, ability to scale, and go-to-market strategy is what will determine the winners and losers in lidar.

This is where Ouster stands apart. We have a highly differentiated technology along with a diversified market strategy and proven ability to execute. We are strategically investing in areas of the business that will enable us to scale rapidly across our target verticals, deliver even more performant sensors, and add new high-margin revenue streams to our business, such as software.

LM: You quite rightly demurred when I asked you during the interview about rumors regarding the possible acquisition of Sense Photonics, but this actually happened, and the deal was closed on 25 October 2021. Would you please explain what Sense Photonics brings to the table for Ouster? Also, do you see this as part of the consolidation that we all think is likely to take place in the industry, which we discussed during the interview, or is it more of a vertical integration along the supply chain?

AP: At the time I couldn’t comment on the rumor as there was no deal signed. Of course, since then we announced the acquisition of Sense Photonics, which accelerated Ouster’s automotive strategy by over a year and solidified our position as a frontrunner in the automotive market. We brought on a strategic development deal with a global automotive company and a pipeline of potential high-volume production deals under negotiation, along with really great automotive and engineering talent from the Sense team.

This is typical of maturing industries, and the winners in the space will likely be the consolidators. That being said, we’re not interested in analog lidar technologies. Sense was developing a VCSEL/SPAD14 digital lidar architecture similar to Ouster’s solid-state sensor, so there were synergies to benefit from.

We have seen some lidar companies vertically integrate along their supply chain, which I suspect is because their input costs for things like lasers were too high. Ouster has a fundamentally different approach which allows us to dual-source components, leverage economies of scale, and benefit from technology advancements across our supply chain, such as with VCSELs and SPADs.

LM: Among the benefits of the Sense Photonics acquisition is progress towards “a flagship development deal with a major global automotive OEM”. Would you like to comment on that? We’ve noticed during interviews with your competitors that the signing of a deal with a car manufacturer or tier 1 supplier seems to be critical to any lidar player that goes through a SPAC. So far, you have had deals with many companies, though I don’t think these include household names of cars, and in your comments on the 2021 results you highlighted your 68 Strategic Customer Agreements, “collectively representing approximately $500 million in contracted revenue opportunity through 2025.” Could you comment, therefore, on the importance of the “big deal”?

AP: While many of our peers have squarely focused on automotive, Ouster has focused on a multi-market strategy that enables us to generate near-term revenue through our 600+ customers, including 68 strategic customer agreements, until the automotive ADAS market begins to ramp in 2025. While there has been some noise from other lidar companies about brand-name partnerships, the automotive market is wide-open. Development deals are really great, but what really matters are high-volume production deals, which very few lidar companies have announced. Ouster is in a number of advanced negotiations for high-volume automotive programs with a start of production in 2025 and 2026. We feel confident about our ability to win automotive deals, which will drive scale to further reduce our costs across our entire suite of products.

LM: Between Ouster’s own heavy investment in R&D and the acquisition of Sense Photonics, is it fair to say that Ouster will launch multiple new products in 2022?

AP: Ouster announced its Digital Flash (DF) series solid-state lidar sensors for automotive late last year15 and we are focused on executing against that product roadmap. We expect to announce our new L3 chip later this year, which will power all of Ouster’s OS sensors, and represents our single biggest performance jump to date. We have also discussed our plans to introduce software later this year. Aside from that, we are not pre-announcing any other products we plan to bring to market.

Endnote

The two memories of the Ouster visit were enduring: older premises atypical of the automotive lidar world; and a brilliant, sincere, self-effacing CEO who has hand-picked a superb leadership team that includes several fellow alumni. “SPAC to the future” witticisms have run their course, but surely the proof of the pudding will be in the eating. The world is crowded with lidar suppliers, both public and those that can’t or don’t wish to take the SPAC step. The winners will be the ones that can use the SPAC funding effectively and rapidly. To do so will depend on sound technological undergirding, a deep appreciation of markets, and a talented, motivated team. Ouster seems well placed in all these respects and its 2021 results suggest that the company is on course.

1 Dr. Louay Eldade, co-founder and former CEO of Quanergy Systems; now CEO of Scidatek, Austin, Texas.

2 Dr. Tianyue Yu, co-founder and chief development officer of Quanergy Systems.

3 By September 2022, Ouster had grown to more than 300 people.

4 ouster.com/company

5 youtube.com/watch?v=9HObyY_7Kmk

6 ipo-edge.com/ouster-ceo-angus-pacala-on-bringing-lidar-into-everyday-life/

7 seekingalpha.com/article/4444246-quanergy-ceo-kevin-kennedy-lidar-of-the-spac-video

8 Special-purpose acquisition company: Ouster completed its business combination with Colonnade Acquisition Corp. (NYSE: CLA) and the combined company’s common stock began trading on the NYSE under the ticker symbol “OUST” on March 12, 2021: https://investors.ouster.com/news/news-details/2021/Ouster-Completes-Business-Combination-to-Accelerate-Digital-Lidar-Adoption-in-Industrial-Smart-Infrastructure-Robotics-and-Automotive-Markets/default.aspx

9 Earnings before interest, taxation, depreciation and amortization.

10 The street in Palo Alto and Menlo Park where many venture capitalists have their offices.

11 lidarmag.com/2020/01/14/lidar-usa-buzzes-with-success-and-innovation/

12 investors.ouster.com/financials/quarterly-results/

13 investors.ouster.com/news/news-details/2022/Ouster-Delivers-on-2021-Guidance-with-34-Million-in-Revenue-and-27-Gross-Margins-Q4-Revenue-Up-53-Aims-to-Double-Revenue-for-2022/default.aspx

14 Vertical-cavity surface-emitting laser/single-photon avalanche diode.

15 ouster.com/blog/ouster-automotive-df-series/