Cepton Technologies is one of many vibrant start-ups leading the way in automotive lidar. Located like many of its competitors in Silicon Valley, it has recently enjoyed a boost in financing through a SPAC1,2. LIDAR Magazine has twice reported on Cepton3,4, firstly when it was about to move into new premises, the interior of which had been carefully designed by CEO Dr. Jun Pei. The company has moved again, forced by rapid growth. The latest facility stands at 399 West Trimble Road, San Jose, California5. The street name may occasion gasps from many readers, but in fact is named after John Trimble, a stockman born in Missouri, who traveled to California in 1849 and settled in the area now known as Silicon Valley in 1853.

I was keen to take the opportunity to obtain an update on Cepton. My visit was once again hosted by marketing and communications manager Faithy Li and I was privileged to have two brilliant interlocutors, Dr. Pei himself and his new VP of finance and strategy, Hull Xu.

Before the formal interview, however, Faithy and Jun accompanied me on a tour of their imposing premises. Cepton moved in after the building had been vacated by AMSL, a leading supplier to semiconductor manufacturers. “They moved to a bigger campus and we captured all their good stuff,” enthused Jun. Certainly, the building was beautifully appointed and pleasing to the eye—the Cepton team has a fine base to work from and won’t grudge the fact that they had only four years in their previous home. On the upper floor, we traversed the software department, the electrical, mechanical and systems labs, and a plethora of conference rooms that was an insight into the company’s culture.

Hull Xu, Cepton’s VP of finance and strategy. Hull was appointed chief financial officer in April 2022.

The number of employees had increased beyond 120, though Jun described this as “slow growth”, noting that the company had celebrated its fifth anniversary in July 2021. We passed a row of executive offices, then went downstairs to see more conference rooms, a manufacturing area and the machine shop. We visited a testing area and Jun explained that it was more structured than testing areas upstairs, because it serves production rather than engineering. There was a production line in operation – this activity, obviously, is not suited to working from home during the pandemic – and a validation lab. Jun said, proudly, “It’s a 90-000-square-foot building, around four times the size of our previous one. It’s a very notable place now.” The calibration area has grown in both size and status as the company has evolved. We saw production managers’ cubicles, a materials storage area, another testing area, with a range of targets, which would be not unfamiliar to a college student in land surveying, for long-range calibration, and a second production area. Having visited Cepton’s previous two facilities, I could not hide my astonishment at the spaciousness of the new one. Jun responded, “After all, we are becoming a public company—that also astonishes you, probably!”

We spoke briefly about the SPAC. Jun was at liberty to furnish details based on publicly available information, though the formalities were not yet complete at the time of the interview. We inspected the “patent wall”, which Jun anticipated would become more heavily populated as the company had around two dozen patents in the pipeline. The final phase of the tour seemed to fill Jun with the greatest pride—a cafeteria, the first Cepton had had, with both indoor and outdoor spaces, in which all-hands meetings were held; and the backyard, complete with barbecues, bocce ball and a fountain that can be used when city regulations permit. Jun is conscious of employee contentment.

We passed test vehicles, including a Chevrolet Tahoe with Michigan plates6. There was the machine shop, of course, complete with Jun’s personal equipment on which he had rhapsodized on an earlier visit, then yet more manufacturing and testing areas, in this case testing sensors against targets of different reflectivities. There is an outdoor testing area too, ensuring that lidar is fully assessed in bright sunlight. Jun pointed out that the company’s processes were much more mature than on my earlier visits.

The layout seemed logical, everything was carefully laid out and labelled, as well as attractive, giving Cepton whatever advantages could be derived from a building and its fixtures and fittings. The spaciousness and the growth of the company it housed, however, held a downside for Jun too: “I start to not know everybody’s name.” I reminded him of his comment in a previous interview that he liked to take a prospective employee for coffee to explore whether the relationship would work. “I think I pretty much lost that,” he lamented. Indeed, HR people and facility managers have joined Cepton. “When you first visited, I used to be the engineer, the machinist, everything,” Jun quipped as we rejoined Hull in the interview room. He had expressed the wish then that the business would run automatically, so he wouldn’t have to come to the office every day. “That remains a desire, not a reality,” he admitted. Jun’s office was much the same as before, still with the piano, but the conference table was larger. “It’s been quite a run in the last five years.” He was clearly delighted that Cepton was becoming a public company.

Lidar sensors mounted on one of Cepton’s Chevrolet demonstration vehicles: Vista-X90 can be seen mounted between the internal rear-view mirror and the windshield and Nova units on the front grille (under the Chevrolet logo), in the rear fender, in the handle of the tailgate, and on the external rear-view mirror.

LM: Let’s talk about the SPAC. It will be lovely in terms of access to capital, but I hope you don’t feel restricted. My understanding is you have to have more members on your board to meet SEC requirements. So there’ll be more people controlling you than before.

HX: One more, from the SPAC entity, and possibly another one, just to meet the various committee requirements.

JP: If you’re doing a good job, smart bosses will not bother you. That’s been true in my entire past career. If you’re not doing a good job, then you have to be supervised. I hope I will continue to do a good job in this place. So the board members are not going to be an issue. Yes, there will be more board members coming my way. And perhaps they can give me even more help.

LM: Presumably you have some influence over the choice of board members?

HX: As we grow as a public company, the corporate governance part, with the right board member choices, will help us solidify some aspects of the business.

JP: Hull is a Stanford guy in electrical engineering, but prior to joining to Cepton, can you imagine, he was an investment banker for a dozen years? One of the very fortunate things for this company is that we can continue to attract talent like this, and we get to work together. Now we actually have professional professionals. Last time you were here, Bob Brown had just joined us—he moved on to some other opportunity.

LM: He had come from one of your competitors. He was very highly rated in this kind of company.

JP: Absolutely. Our current CFO, Winston Fu7, is our series A investor. He’s, what else, a Stanford guy, a physics PhD with an investment background. Stanford is just a cult here. Faithy is from Stanford —East Asian studies. But there’s always a balance. I graduated from Brandeis in the Boston area. In that area the culture in the academic world is rather different—it’s very pure academic—none of this capitalism! Yes, entrepreneurship is great. But sometimes I long for the pure academics.

LM: The last time I was here, in February 2020, you had had the injection of capital from Koito, you had fitted out the office, you had about 100 employees. On the product side, the Vista X-120 and the Helius software. You’ve grown to over 120, you’ve got a fantastic new building, you’ve got some great new people. What happened on the product side?

Bell ringing as Cepton (CPTN) is listed on the Nasdaq on 17 February 2022. Front row of podium party, from left to right, includes George Syllantavos (chartreuse tie), co-CEO of GCAC; Akis Tsirigakis, co-CEO of GCAC; Dr. Jun Pei, co-founder and CEO of Cepton; and Dr. Mark McCord, co-founder and CTO of Cepton.

JP: There was something that I alluded to in February 2020, by far the biggest news in this industry! In December 2019, just a couple of months prior to our meeting, we captured the largest lidar design win from a top-five, Detroit-based OEM8. It ranks as one of the top five in the world by volume. This is by far the largest design win for lidar for any company. It’s a good validation for Cepton and the entire industry. In comparison, you’re aware of Innoviz’s design win with BMW and Luminar’s with Volvo. By the same ranking9, BMW ranks number 13 worldwide in sales volume, Volvo ranks 28. If you combine all the ADAS design wins out there by volume, it’s only a fraction of what we have won. It is a 2023 program for production cars, not demonstration vehicles but everyday consumer cars. In a couple of years, you’ll be able to buy a car, from a dealership near you, with lidar inside. This is a huge milestone for Cepton. We buried our heads—to answer your question—for the last 18 months, we embarked on the journey to execute this largest design win for the industry. We’ve delivered A samples, B samples, C samples10, if you’re familiar with all those terms associated with automotive programs, and, so far the execution, even under the very difficult circumstances of covid, has been carried out pretty nicely.

Cepton features on the Nasdaq tower, Times Square, New York, on the day of the bell-ringing, 17 February 2022.

LM: That explains what you’ve been doing! Innoviz has lots of very able people as well11, although they’re different in the sense that the top management all met each other in the Israeli military.

JP: Absolutely. Especially when you start companies like this, in this risky, competitive environment, having buddies with the same cultural and educational background is one of the key elements to success.

LM: On the product side, I think since we last spoke, Nova is new. And Vista has several variants.

JP: The major design win is still based on the MMT12 that we have developed in this company. We’ve talked about it a couple of times in the past and it hasn’t really changed. The win is very much a Vista-derivation. It’s another slight change of the Vista design that will fit into the vehicle, but it’s based on the same technology. So there’s the Vista variation and there’s Nova, which is meant for near range and smaller distance. For the automobile industry, we see, in the not too far future, these high-performing, near-range lidars have a chance to replace ultrasonic sensors to provide an even higher level of safety, as the car starts from zero speed. If you count all the accidents for cars, one of the most dangerous occasions is actually when the car starts from zero, for example in the garage, when you have stuff or people around you.

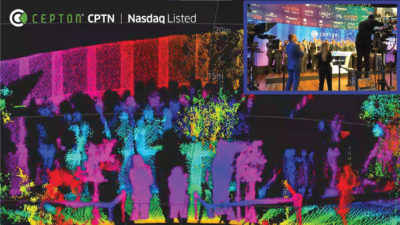

Cepton took its Vista-X90 lidar sensor to New York to record the Nasdaq bell-ringing ceremony on 17 February 2022.

We’ve always had a focus on the ADAS industry, promoting additional safety for cars, before autonomy. Even in 2016, there was a bandwagon of autonomous vehicles on level four, so you saw many companies trying to aim high for the big pie, which never came. We aimed at everyday consumer cars and this enabled us to get this largest design win. Looking back, I think it really is the correct direction. First and foremost, lidar will be in the consumer cars marketplace, to promote additional safety, not just autonomy. Of course, a benefit is additional automation that brings us from level two to level two plus and towards level three, which is how you can reduce the accident rate by 30%, 50%, or even 90%. That’s where lidar brings tremendous value to consumers.

LM: You won a couple of 2021 Tech AD Europe awards13. Congratulations.

JP: Thank you. We’re starting to make a name for ourselves out there, slowly, gradually. Cepton has been an understated company. Until today, not many people knew that this is the place with the largest ADAS win and it’s a dominant force—MMT is going to be the future, at least for the next decade. That will be the technology in cars.

LM: One of the things that must be remarkable to people outside the industry is how many SPACs are lidar companies. There’s you; Velodyne was one of the first ones; then Quanergy, AEye, Aeva, Innoviz and Ouster. A SPAC gives you quicker, better access to capital than the traditional VC route. Is that right?

JP: To me, yes, absolutely!

HX: There are a couple of factors. For a traditional IPO, investors typically don’t look beyond two years, in terms of revenue visibility, but lidar companies’ value is in the more distant future, especially in the automotive market. For a SPAC transaction, the company is allowed to communicate its future prospects directly to the investor, whereas in a regular IPO, it’s not. That’s a key factor why lidar companies have chosen the SPAC route to communicate their stories.

LM: The other things I don’t quite understand are, how do you decide the timing, and how do you choose your SPAC company? In your case, it was Growth Capital Acquisition Corporation. Did they choose you? Or did you choose them? And when?

HX: It’s a mutual process. We did talk to a number of interested parties and we did receive a number of interesting term sheets. We chose Growth because they have quite a bit of experience in SPACs. This is not their first, or their second, but their fourth SPAC. They’ve been doing SPACs for over 10 years now. And they also are operators. We saw these two benefits, so we decided to go.

LM: This is a question because my readers are not fintech people. Koito is providing another $50 million through a PIPE14. If they’re doing that, why do you need a SPAC?

HX: Koito, as you know, is our long-term partner, our tier-one partner, so they know more about us than most any other investor. They have confidence in us, so we asked them to come into the PIPE as a way of supporting us. And they’ve agreed.

JP: There’s always more than just the financial stuff for going public. There’s marketing: if you’re a public company, you’re better known, better recognized and the operations are more transparent. That promotes credibility as we do further engagements with future partners and consumers. So it’s not just, Koito gives you $50m and you hide away. We can no longer afford to be a closet operation. Now we’re coming out of the closet, we are an important lidar company, we’re the dominant force in the ADAS industry. We’re going for public, we’re going to establish ourselves in this open market.

LM: Koito is going to manufacture for you as well?

JP: For this specific ADAS win. Koito is the tier one, we’re the tier two and they will be the manufacturer and the product will come out of Japan. Yes.

LM: So they’re called a tier one and you’re called a tier two?

JP: The tier-two-tier-one OEM structure is a very well-established, structured supply chain for automotive manufacturing. In this case, we’re adopting that same methodology. Just to clarify, Koito and Cepton are not exclusive to each other. We have additional partners and supply chains to work with. But for this specific project, yes, we are together.

HX: Technically, we’re a tier two, but we’re almost like tier 1.5, because lidar is such a new technology and we are leading the discussion directly. Also, we’re leading some of the manufacturing—calibration and other steps—in conjunction with Koito. With some more mature technology, you have tier one, tier two, where the tier two doesn’t really speak to the OEM. That’s not the case here.

LM: Many lidar companies have SPACs. Is this like all boats bobbing up on a rising tide? Can you say that your SPAC is better than someone else’s? What’s happening?

JP: A SPAC is a SPAC, just like an IPO is an IPO. That’s what I call a process, a capital-raising process. Ultimately what matters is whether the company can do what it promised to do and can deliver what it promises to deliver. I keep coming back to the largest design win we have, these are solid contracts with solid revenue that’s going to come in, starting from 2023. These are huge numbers, just from the beginning of this program. And for companies just going public, just going through the SPAC process, having or not having solid automobile contracts is going to be the speaking power.

LM: Having access to capital means that you can do what you have to do to get there, in the sense that you need to organize manufacturing, you need to optimize the manufacturability of the product. And now you have the flexibility, the means to do that.

JP: All these elements—manufacturability, supply chain management, scalability, reliability, and quality of your product—all of these things associated with volume production come with a prerequisite that you must have a design win. If you don’t have a design win, you don’t even get to work on these things. There are not many people, maybe you can count them on one hand, who actually have a meaningful design win. So that’s how selective the lidar company landscape is. You can say, I don’t work on ADAS, I work on some niche markets. But if you look at the total addressable market in the next decade, ADAS occupies more than 80% of the entire lidar market. So it’s a matter of choice whether you compete in this 80%. It’s almost winner takes all, given the size and the spread being so heavily concentrated on ADAS.

LM: We had a chat last time about how extremely talented people move around in the industry and in the Valley and, of course, Cepton is an example of this now: you have a new CFO, replacing Bob Brown. As you said, most of that movement is inward.

JP: A few people have moved out to other lidar companies, but the inbound is a lot more. And as we announced our SPAC, you can imagine there are even more. I’m a bit surprised and proud to hear that last time you were here we were about 100 people. Now we’re a little over 120—it’s very slow growth. We’re so selective in hiring people with top talent—it’s a hard process.

LM: There are probably somewhere between 10 and 30 lidar manufacturers. They’re not all going to survive. There will be consolidation and shaking out.? What do you think’s going to happen?

JP: I’m not a prophet with a crystal ball. I always come down to fundamentals. Whether it’s consolidation or otherwise, it has to make business sense, which comes from winning contracts and having solid revenue paths. Do I see consolidations leading to that? I’m not so sure. Some shape and form may be helpful.

HX: When I was at RBC Capital Markets, I covered auto tech and over 60 lidar companies. Automotive is the largest chunk of the total addressable market. The space outside automotive has a very different dynamic in terms of projects being a lot smaller. In order to achieve the same revenue, you have to get a ton more customers. It’s a much more fragmented market. The total addressable market does not really support 60 lidar companies. Inevitably, there’s going to be some consolidation and some are just not going to make it. Jun talked about the fundamentals in terms of commercial traction. My view is that the ones with the largest commercial traction by definition are going to be the players with the biggest market share. Those are going to survive and thrive. In the early stages, companies which don’t have as much commercial traction but do have some kind of technology that could be beneficial to others will be consolidated into others, but some are just not going to survive.

LM: We have an article in the magazine by a company called Lumotive15. They’re into very small sensors, physically small, and therefore they’re interested in the very close-range market. There’s a market there. I’m sure Jun has explained to you that the magazine come from a geospatial background. When I got into lidar, systems flew up to 5000 meters and there are really only three companies do that, one Swiss, one Canadian, and one Austrian. It’s been like that for decades. And they only overlap with you in the tiniest possible way. They make sensors that fly on UAVs at 100 meters, but they cost 10 times as much. Their performance is better in terms of noise level, but you could put three or four of your sensors on the UAV and maybe with some math get to the same answer. It could be that there’s not just niche markets with niche technologies, but also some of these companies may have a better market understanding—they may be focusing their sales efforts in particular areas.

HX: Everything could be a balancing act, whether it’s focusing the sales effort or focusing R&D efforts on niche markets. That’s obviously the choices of those companies. Some lidar companies, maybe because of their addressing that niche market, are going to be smaller. They’ll be around.

LM: These other markets are much more difficult to understand. I think that, after ADAS and AVs, you’ve talked about smart infrastructure, then you divide that into smart cities, smart spaces and smart industrials. That’s a good classification. Other people might classify it slightly differently. But I think it’s just harder to do than automotive.

HX: I think in automotive we get the best return from our efforts. For example, the, design network, the series production network that we have, is one thing. With customers outside automotive, you might have some customization with each deployment—imagine the amount of engineering resources and application support that has to go on for each of these customers. It’s just a different game. We cater to those applications as well. We utilize our partners and production partners in those spaces to help with the customization, but we supply the core technology.

HX: On the SPAC process, there is another filing with SEC that we will need to do next week. It’s a very thick disclosure, much more information will be contained in that disclosure than our announcement investor deck. So there’s a lot of good information if you have the time to read through some of it16.

LM: And when do you think you’ll finally be listed? What will be your ticker?

HX: Our ticker is CPTN. In terms of exactly when the transaction will close, we anticipate Q4 of this year, but it really depends on how fast the regulatory bodies get back to us17.

LM: Will there be enough work for you and the CFO to do once this happens?

HX: There’s definitely plenty of work. My role here is finance and strategy. As a public company, we have many things to work on. On the strategy side, as you mentioned earlier, it’s a crowded lidar space. There may be other things that will happen. Obviously once we’re public, there is going to be a lot of investor interaction. Part of my job is also to handle that piece of the work and we may need to have additional help on that. We also have an IR18 advisor, just to focus on investors. But it’s an ongoing effort.

JP: As part of the company growth now, we have really talented people with professional backgrounds in this organization.

LM: To me as an outsider, I think it’s important that you and Mark19 can remain focused on the technology because after all, that’s your expertise. That’s where you came from. You’ve got some of the patents.

JP: If you always consider me as the technical guru in the company, then we’re going to be falling behind. New people bring a fresh breath of air and new blood infusion. There are plenty of technical people here better than I. I lost a lot of jobs in this place!

LM: I’m grateful to you for having me in at such short notice and making me so welcome. Because I saw the SPAC announcement, I knew that I needed to talk to you again! And thank you, Hull, for joining the meeting.

JP: We’re very thankful that you can come here and I get to show off the new building.

On the way out, I encountered Cepton’s then CFO20, Dr. Winston Fu. His PhD, of course, is from Stanford, in applied physics, but is preceded by an MBA from the Kellogg School at Northwestern University and a BS from MIT in applied physics. While I had never doubted Cepton’s strength in depth on the technology side or its entrepreneurial spirit, I left San Jose equally impressed with its freshly hired expertise in financial engineering. Cepton’s design win with its Detroit-based client is the sort of success expected from an automotive lidar player, especially after a SPAC. Cepton has the technology and the acumen to justify its place in the premier league.

1 Special Purpose Acquisition Company. LIDAR Magazine attempted to explain the SPAC process in an article about Velodyne Lidar:lidarmag.com/wp-content/uploads/PDF/LIDARMagazine_Walker-Velodyne_Vol10No4.pdf.

2 cepton.com/announcements/cepton-technologies-and-growth-capital-acquisition-corp-announce-closing-of-business-combination

3 lidarmag.com/2018/04/27/cepton-technologies

4 lidarmag.com/2020/09/05/intelligence-at-the-speed-of-light/

5 news.theregistrysf.com/cepton-takes-92000-sqft-in-san-jose-for-new-headquarters/

6 One week after this interview, the news came out that Cepton’s big contract is with General Motors: forbes.com/sites/samabuelsamid/2021/09/09/general-motors-selects-cepton-to-supply-lidar-for-2023-production/?sh=31520f9e701e. This article also confirmed the SEC filing to which Hull referred in the interview. In its S-4 filing (SEC Form S-4 is filed by a publicly traded company with the Securities and Exchange Commission and is required to register any material information related to a merger or acquisition), Cepton had revealed that it had been, “awarded a significant ADAS lidar series production award with Koito on the General Motors business.”

7 With Hull being appointed to CFO, Winston remains a board member and is now Advisor on Strategic Projects

8 cepton.com/announcements/cepton-secures-industrys-largest-adas-lidar-series-production-win-with-leading-detroit-based-global-automotive-oem

9 IHS light vehicle production volume rankings for 2019

10 According to Cepton’s Q2 2022 earnings call, the company had been delivering D-samples by Q2 2022. https://investors.cepton.com/static-files/c9fc0d37-5e01-427b-af73-de8911ed7994

11 lidarmag.com/2021/08/18/israeli-automotive-lidar-supplier-leapfrogs-into-sight/

12 Cepton’s patented Micro Motion Technology.

13 businesswire.com/news/home/20210819005247/en/Cepton-Lidar-Innovations-Score-Twice-at-the-2021-Tech.AD-Europe-Awards

14 Private investment in public equity. See the article cited in footnote 1.

15 lidarmag.com/2021/08/18/short-range-lidar-opportunities-and-challenges/

16 This was the S-4 filing referred to in footnote 6.

17 Cepton was listed on the Nasdaq on 11 February 2022, some weeks after the interview. Photographs of the events are included here to underlines the celebratory nature of the occasion.

18 Investor relations.

19 Dr. Mark McCord, Cepton’s CTO.

20 cepton.com/about-team/winston-fu