LIDAR Magazine has reported on several lidar suppliers that focus on the automotive market and has commented on their experiences in merging with SPACs1 to ensure deep enough pockets not only for R&D but also for productization, sales and production at scale. Further keys to success include leading-edge technology; the very best talent in terms of both technical and management skills; a superbly trained, flexible workforce; willingness to attack the ADAS2 market while waiting for autonomous vehicles (AVs) to become widespread, yet not losing sight of other markets; and the skills required to navigate the challenging waters between an exciting, operational product and its manufacture in the quantities and quality required by the automobile market. One of these winners is AEye, Inc., which is located in Dublin, California and has offices in Germany, Japan and Korea3. LIDAR Magazine was offered the opportunity to interview Luis Dussan, AEye’s founder and CTO.

LM: Luis, thank you very much indeed for agreeing to talk to LIDAR Magazine. First of all, let’s get to know you a little better. After an undergraduate degree in EE and computer science, you worked with NASA, Lockheed Martin and Northrop Grumman before founding AEye in 2013. During these years you completed two master’s degrees at the University of Central Florida in optics, photonics and physics. Could you please summarize your working life and explain how your ambitions grew and matured, with the result that you founded AEye? In particular, your career has perhaps more of a defense component than the founders of other lidar companies—has that made a difference?

LD: A key differentiator in my career is that, as I was studying for my post-graduate degrees, I was also working at companies such as Northrop Grumman and Lockheed Martin as a researcher and engineer. Because of this, I was able to study many concepts that I could immediately apply to my work. I was also exposed to classified programs and cutting-edge technologies.

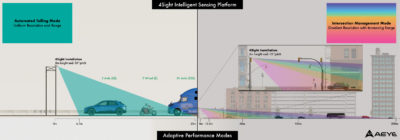

4SightM—A software-configurable MEMS lidar designed to adapt for intersection management, automated tolling, improving highway incident detection, and optimizing other industrial applications.

Early on, I was able to understand new technology life cycles in even the most complex of applications, from initial design to the end product. This was a precursor to identifying and addressing both the challenges and opportunities in building a complete commercial-grade lidar and perception solution.

In fact, it was my defense work that inspired a robust AEye solution. While at Northrop Grumman and Lockheed Martin, I was designing mission-critical targeting systems for our fighter jets and special ops units that searched for, identified and tracked incoming threats. I realized that a self-driving vehicle faces a similar challenge: it must be able to see, classify, and respond to an object—whether it’s a parked car or a child crossing the street—in real time and before it’s too late.

What intrigued me most was artificial intelligence, and the possibilities of software to calculate complex things like intent. Before AEye, software and hardware were siloed and AI was really an afterthought. That is a big part of the AEye difference: we combine hardware and software to create a robust solution that powers the future of safe autonomy.

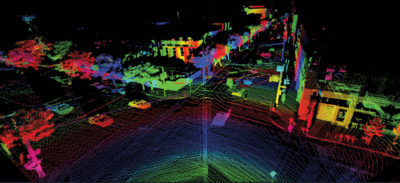

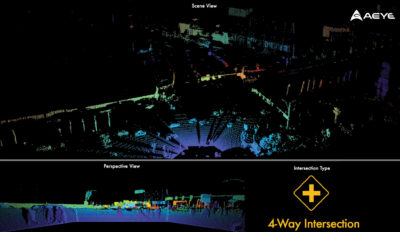

High-fidelity point-cloud display of AEye’s 4Sight platform captured while driving in dense urban environments.

LM: Our magazine comes from the geospatial side, where lidar is a tool that has transformed the world of surveying and mapping over the last 25 years. More recently, this world, particularly the application of UAVs for data collection, has been further transformed by the arrival of economical, reliable sensors from the automotive world. But there’s more to it than just sensors—there’s the computer hardware and firmware, the communications and, importantly, the perception engine. Could you please give an overview of AEye’s product range and how your company fits on the spectrum that is perhaps a way of defining the supplier side of the market: companies that offer (i) sensors only; (ii) sensors, SDKs and development tools; (iii) sensors and software that runs all the way to the perception engine; (iv) systems that include not only lidar but other sensors too, such as cameras and radar; and (v) software only?

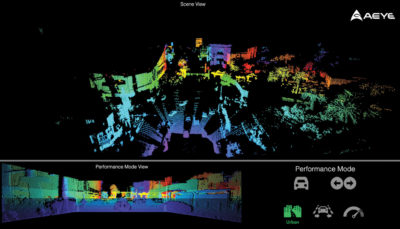

The 4Sight Intelligent Sensing Platform allows tailored performance modes to solve multiple use-cases using the same hardware.

LD: We are on the higher end of the spectrum: we offer sensors, like a mechanically fused camera and adaptive lidar and a development kit. We have automotive ADAS, mobility, and industrial solutions. Our industrial and mobility solutions include cameras with multiple sensors, and that includes software and SDKs that we provide. AEye’s advanced technology can be used in multiple applications, not just automotive: our sensors can be used in rail, trucking and smart city applications—we like to say it’s next generation perception for everything that moves.

LM: Your offering includes 4Sight A and 4Sight M, one based and the other built on AEye’s 4Sight Platform. Could you please describe this architecture, product, and the underlying technology? In particular, could you explain, for those of us who don’t enjoy a physics or EE background, how your bi-static approach differs from—or has similarities to—the “multiple pulses in the air” technology employed by the purveyors of lidar sensors for data acquisition from manned aircraft?

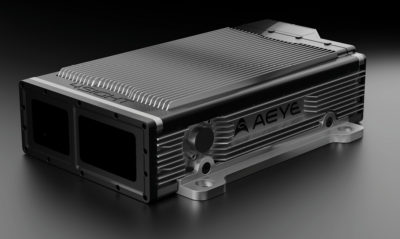

LD: Sure. We offer a customizable lidar product for industrial and mobility markets, the 4Sight M, and a software-configurable reference architecture for ADAS, the 4Sight A. With 4Sight M, we sell directly and through systems integrators to the industrial and mobility markets for applications ranging from trucking and rail to intelligent transportation systems, and aerospace and defense. With 4Sight A, we license our reference architecture to AEye’s Tier 1 partners like Continental, who manufacture their own custom products and sell these solutions to their automotive OEM customers.

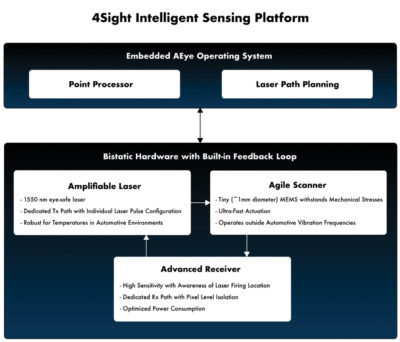

The 4Sight M and 4Sight A are based on our 4Sight™ Intelligent Sensing Platform, an adaptive lidar platform which employs principles from automated targeting systems to scan the environment, intelligently focusing on what matters most. What is truly revolutionary about AEye’s system is our bi-static, agile design, where we separate the transmit path from the receiver. Other lidars typically have the transmit and receiver use the same aperture and path—which is called co-axial. At AEye, we keep them separate. This enables the system to be independently software configurable so that we can optimize both the transmission of each laser pulse—and the receiver that is going to capture the returned data. This lets us create an adaptive, weather-robust, intelligent system that captures higher quality data. It also allows us to put the complexity of the system in the software—where it is easier and faster to incrementally innovate and optimize. This approach enables us to deliver world-leading performance in range, speed, and high-density resolution, on-demand.

The Continental HRL 131—An adaptive, high-performance MEMS lidar, based on AEye’s 4Sight reference architecture, designed for level 3 and level 4 applications to improve assisted and automated driving in passenger cars, robotaxis, and long-haul trucking.

Our bi-static, agile architecture with programmable receiver can look at different areas, similar to “multiple pulses in the air” technology, but in many ways better than what the military employed in the past. Our product is automotive-grade with a high-precision, software-definable, adaptive lidar. This approach enables us to deliver higher quality, more accurate information faster to the perception system to improve the safety and efficiency of automated and autonomous vehicles and machines.

LM: Can you please give an indication of the price points of your products?

LD: The price points of our products depend on the volume. In general, we are significantly below the average market price.

LM: There seems to be an emerging consensus that lidar is critical to autonomous vehicles, ideally complementing cameras and radar into powerful solutions that maximize safety. But there’s more to automotive lidar than simply sensors that provide strong performance at ranges of up to, say, 300 m, with appropriately high resolution and scan rate. They have to be solid-state, MEMS-based and capable of some element of software control. They have to be very robust and must operate in a broad range of weather conditions, including rain, snow, and bright sunlight. And, above all, they have to be manufactured at scale, in such a way that the units display an amazingly high degree of reliability. Is this a fair summary of the situation? Please explain how the AEye product range fits into this model.

AEye’s 4Sight platform captures pedestrians in the near-range with cross-traffic in the background at a 4-way intersection.

LD: Yes, this is a fair summary. We are one of only two companies that focus on long-range, high-performance lidar and the only company with an adaptive, intelligent lidar solution. Lastly, we are likely the only system that will be reliable enough, especially at range with high performance, to be truly automotive-grade, and this comes from the tiny MEMS we are now well known for. In addition, our hardware components are completely software configurable, creating a powerful, intelligent sensor system that is both flexible and adaptable to different or changing environments and weather conditions, as well as varied markets, applications, and use cases.

We use a simple design with four core components: a 1550 nm amplifiable fiber laser, with proven superior performance in rain, snow, smoke and other visual obscurants; a proprietary tiny MEMs-based scanner, with proven durability and reliability; a receiver with a bi-static design that enables the system to be independently software-configurable so we can optimize both the transmission of each laser pulse and the receiver that is going to capture the returned data; and our SOC4—where the system’s complexity lies—making it easier and faster to incrementally innovate and optimize. And yes, our design means AEye’s sensors can be put in the roofline, behind the windshield, or in the headlight or grill—enabling automotive OEMs to make design-centric decisions without impacting lidar perception performance, which is key to widespread lidar and sensor adoption.

LM: We listened to a Reuters webinar in which Jordan Greene5 was one of the panelists. Dr. Gunnar Juergens of Continental contrasted how far forward radar had advanced as an automotive sensor compared to lidar. For example, in the case of his company, lidar lagged radar by about 100 million delivered units! This seems strange to us in LIDAR Magazine, since lidar technology has been around for 50 years. Could you give a perspective on this, please? Why is radar so far ahead?

LD: The differences are in the components associated with lidar and the problems that the industry needed to solve. When first introduced, in general, nobody had thought of a reason to use lidar that radars and cameras couldn’t also solve. To boot, radar was less expensive than lidar primarily because of the optics, lasers, and scanners required, so early implementations were limited to places like the military, which has used it extensively. But then a new industry problem arose. While radar could accurately measure distance with limited resolution, lidar could also accurately measure distance but with a resolution that was fundamentally three orders of magnitude better than radar; this was hard to beat. This is why lidar can see smaller objects and details further away.

With the development and interest in ADAS and autonomous mobility (driverless navigation), there is good reason to use lidar. It had to be given the problem to solve. That problem is deterministic or non-interpreted long-range detection at high resolution, and small-object detections at a long range—both of which must be solved to create safe autonomous mobility.

Now add to that the fact that the costs are coming down, due in no small part to the investments made by many players in the field. In just the past three years lidar has seen a massive price drop, and as we see the automotive market ramp up volume production, we’ll continue to see cost-downs and economies of scale that will parallel that of radar and cameras.

LM: Turning to the business side, we notice that you went public through a merger with special purpose acquisition company (SPAC), CF Finance Acquisition Corp III (CFAC.O), in a deal valued at $1.52 billion. Our readers are becoming, rather unusually for a technical magazine in the geospatial field, familiar with SPACs and PIPEs, since Velodyne Lidar, Ouster, Luminar, Quanergy and Innoviz, to name but five, have followed the same route. Could you please explain how you came to go this way and what stage you have reached right now? Also, please say why this works better for you than either conventional IPO or VC funding rounds.

LD: We completed a successful merger and became a public company listed on Nasdaq under LIDR in August 2021. Because of the high demand for our products, the SPAC route proved a solid one for us to scale and to do so quickly, and with ample funding we are well-positioned to tackle the immense market opportunity.

LM: Companies like AEye typically start with a founder, or perhaps two or three co-founders, one of whom plays the role of CEO. But you are founder and CTO, whereas Blair LaCorte is CEO. Could you please say more about this choice of structure and about how well it works? How did you form the original leadership team to get the company started?

LD: Those two titles, CEO and CTO, are appropriate for a Silicon Valley start-up to divide and conquer the rigors of running a growing company. Both roles require creativity and vision. The CEO applies those skills to solving company-wide challenges in the areas of marketing, finance, business and corporate development, but is also involved in securing deals and understanding the market. These are among Blair’s strongest areas of expertise. A Silicon Valley CTO requires creativity and vision in cutting-edge product design and development, building and leading tech teams, and carving out the best technology path for the company, but also securing deals and understanding the market. The transition in our roles makes a lot of sense at this stage of our company’s growth and product development, and in preparation for the next milestones of volume production and our new life as a public company. Note that I said that we both take part in deal-making and understanding the market. That is an aspect of our relationship that I enjoy, where we bring different perspectives and fuse them together to get those things done. And that’s just Blair and I. It is truly the combined expertise of our leadership team that makes AEye stand apart—not only in technical prowess but also in proven management experience. Jordan, Allan, Bob, John, Rick6 and others on our leadership team really make us whole.

LM: We’ve also noticed that the consummation of a SPAC merger tends to result in the lidar company making changes to its board of directors. Is AEye doing this?

LD: Yes, AEye announced the election of our Board of Directors shortly after the closing of our merger. These new members bring extensive public governance, legal, and financial management experience, as well as deep domain expertise in automotive, aerospace, and defense markets. The new board is chaired by Carol DiBattiste, an experienced public and private company senior executive, with a background in heavily regulated markets and government agencies. Timothy J. Dunn, a veteran public company financial management executive, serves as chairman of the audit committee. Former Apple global marketing production lead Sue Zeifman chairs AEye’s marketing committee, and Professor Dr. Bernd Gottschalk and Dr. Karl-Thomas Neumann, both automotive industry veterans, serve as additional independent board members, alongside current AEye board members Wen Hsieh of Kleiner Perkins, Blair and myself.

LM: We’ve further observed that many highly able, proven executives seem to move between different companies in or near Silicon Valley. This could be said of some of the AEye leaders. Is this a good thing, i.e. brilliant talent finds its way to where it contributes the most? Is there any danger to IP?

LD: We are thrilled with the talent in the Valley, and the executives who are choosing to bring their considerable talent to AEye. We’ve recently attracted several top-notch executives from within the lidar and automotive ecosystem who are drawn to our differentiated technology, appealing licensing model, and collaborative workplace. So, yes, I think they are coming to a company they believe in, with a culture they want to be a part of. In regard to IP, if you have a solid organizational structure along with a mature and talented management team to properly safeguard IP, as we do, IP should not be a concern.

LM: Critical factors for the success of a company like yours seem to include relationships with automotive manufacturers and/or with Tier 1s, whereby the latter may be your customer and/or may provide the capabilities you need to manufacture at scale. Could you explain where you are in this part of the process?

LD: We believe in working within the established automotive ecosystem, partnering with trusted suppliers who have decades—and in some cases more than a century—of experience producing automotive grade products in volume, at scale. To that end, we have partnered with a handful of best-of-breed automotive Tier 1s, including Continental, to commercialize and manufacture our lidar sensors. Continental has industrialized our long-range lidar sensor (the HRL 131), is building a manufacturing line around it, and is scheduled to begin mass production in 2024.

While other lidar players are trying to scale up organically, we’ve thought through our licensing so we can proliferate faster. The automotive industry knows how to produce robust components efficiently and at a low cost. Partnering with a Tier-1 supplier such as Continental enables AEye to scale, not just in the automotive industry, but in other markets as well.

Along with this, Tier-1 suppliers have been and are actively looking at lidar companies and their technical approaches. Companies such as Continental and Hella performed months of due diligence before selecting AEye as a partner—a key validation of our model and our team. They chose us because of our technology, and the scalability, adaptability and robustness of our design. Tier-1 partners will work only with viable companies that have solid technology and are designed for large scale manufacturability, and we certainly fit that bill.

LM: Your primary market is, of course, AVs and ADAS. Are you doing anything in robotic vision, outside the automotive sphere? Furthermore, you have an aerospace background. Your sensing pattern can achieve a range of 1000 m, way beyond most of your competitors. Are you looking at other markets, for example, as part of payloads for UAVs or even crewed aircraft or helicopters? Or, indeed, what about applications in ground-based surveying, whether on moving vehicles or stationary?

LD: Yes, we are definitely pursuing opportunities outside of ADAS and automotive mobility. In addition to these markets, we are actively working with companies in trucking, rail, mining and ITS7. For example, we announced a development partnership with global self-driving technology company TuSimple and an integration with Seoul Robotics to deliver adaptive, long-range perception for ITS. As part of our plan to scale up, we are looking at markets that are relevant to our mission and business model that can benefit from AEye’s lidar system, and thoughtfully entering those markets as quickly as possible.

LM: We are sure that one of your major goals for 2021 was completion of the SPAC merger. But what else would you like the company to achieve by the end of 2022? Do you also have longer-term aspirations?

LD: This year and moving forward, we’re focused on scaling the company effectively, securing design/production wins with our Tier-1 go-to-market partners, and lining up development deals in the industrial and mobility markets, while continuously improving our system’s performance.

LM: Luis Dussan, thank you very much indeed for answering our questions. We look forward to further articles about AEye in the future.

1 Special purpose acquisition companies.

2 Advanced driver-assistance systems.

3 www.aeye.ai

4 Software on a chip.

5 AEye’s co-founder and GM of Automotive.

6 Jordan Greene; Dr. Allan Steinhardt, chief scientist; Bob Brown, CFO; John Stockton, SVP of R&D; Rick Tewell, COO.

7 Intelligent transportation systems.