We have often acknowledged in these pages the difference that lidar suppliers focused on the automotive sector, on both ADAS (advanced driver assistance systems—available now) and autonomous vehicles (AVs, which will surely transform our lives in the next decade), have made to the geospatial world. In particular, their lightweight, economical lidar sensors have made UAV-lidar popular and some of the resulting integrated systems have appeared also on vehicle-based mobile mapping systems.

One such supplier is the Israeli start-up Innoviz Technologies1. Its marketing pitch goes:

The company’s commercially available, solid-state lidar sensors and perception software enable safe autonomy by bringing unparalleled optics, seamless design and cutting-edge software to market. Going beyond cameras or radar, Innoviz’s lidar provides a comprehensive 3D image of a scene.

The company was founded in January 2016 and is backed by top-tier strategic partners and investors, including Magna International, Samsung, Aptiv, Magma Venture Partners, Vertex Ventures, SoftBank Ventures Asia, China Merchants Capital, 360 Capital Partners, Glory Ventures, Naver and others.2

Innoviz announced on 6 April 2021 that it had gone public through a merger with special-purpose acquisition company (SPAC3) Collective Growth Corporation and had raised $371 million. For a lidar start-up, this is a significant sum, so we approached the company for further comment. The result was an interview with Oren Rosenzweig (OR), co-founder and chief business officer.

The Zoom call was hosted by Chelsea Lauber of New York PR firm Antenna Group. Eric Lachter, VP brand marketing at Innoviz, was also on the line—he’s a marketing executive, based in Marin County.

Oren was speaking from Innoviz’s office in Rosh Ha-ayin, Israel. Here’s what he said.

LM: Oren, please tell us about yourself and explain how you came from your early years and your MBA into Innoviz.

OR: My background is similar to that of the other founders of the company. We spent seven years together in the Israeli Defense Forces (IDF), specifically in the Intelligence Corps doing R&D for advanced electro-optics systems. I worked a couple of years with Anobit Technologies, which was acquired by Apple and is now Apple’s biggest R&D center outside Cupertino. Then I spent a couple of years in business school in Chicago [Booth School of Business, University of Chicago], then consulting for BCG [Boston Consulting Group] in New York. While I was there, I was working with Omer [Keilaf; now CEO of Innoviz], one of my co-founders and a good friend of mine from many years in the military. To cut a long story short, we started working on Innoviz, then we raised a series A [venture capital] at the beginning of 2016. So I moved back to Israel after that. Since 2016, I’ve been in Innoviz leading the product and sales, with the title Chief Business Officer. So there’s the technical side and the sales side—we have sales teams in the US, Germany and China, and we’re hiring in Japan.

LM: How many people does Innoviz have at the moment?

OR: Just over 300. We grew quickly. We were four founders back at the beginning of 2016. We just recently went public through a merger with a SPAC, and just a few weeks ago started trading on the NASDAQ under the ticker INVZ.

LM: Your shares have gone up more than 10% since you launched?

OR: We’re not very focused on the short term. The idea was to raise a significant amount of money for the company in pretty short order, which this transaction allowed us to do—we raised over $370m this way, much quicker than an IPO would do and, I think, quicker than a private round would be at this stage of the company. Now we have the money to execute on everything we need—getting the product to customers like BMW, and many other things that we’re doing. It’s very exciting now.

The founders of Innoviz Technologies: Oren Rosenzweig (left), chief business officer; Omer Keilaf (center), CEO; and Oren Buskila (right), chief R&D officer. The three met while serving in the elite technological unit of IDF’s Intelligence Corps. The model in the foreground underlines the importance of Innoviz’s BMW customer.

LM: When I finished my MBA 17 years ago, the financial instruments weren’t the same. But it seems that, just viewing the lidar world, you can get a lot more money by joining with a SPAC than in a normal venture capital round—some of the lidar companies were talking of rounds in the single digits or tens of millions of dollars, but not hundreds of millions.

OR: Yes, it opens up the door to additional types of investors who can write bigger checks. It offers a lot of predictability in terms of valuations. There’s a nice mix of the private and the public side too. We did a lot of marketing to the PIPE4 investors, and you can get a lot of visibility from going through that type of transaction in terms of raising the SPAC and PIPE funds, and, following it, when you start trading on the public exchange.

LM: Going back to the beginnings, the founding of Innoviz, did you and the other members of the management team who were in that elite unit in the IDF, did you meet there or did you meet afterwards?

OR: We worked together there. Omer is the CEO. He and I were in the same team for five years. We’ve been very close friends for 20 years now. We worked very closely together on the same projects. At some point we split, I went to the US, then we joined forces again to start Innoviz.

LM: I have another question, trying to understand how high-tech companies like yours work. You’ve recently announced an expansion of your board of directors, but you’ve got an incredibly talented management team already, so what’s that about?

The sensors: InnovizOne (above and below) and InnovizTwo (bottom). Both sensors use a 905 nm laser. The InnovizOne measures 45 x 110 x 95 mm and weights 515 g. It offers a resolution of 0.1 x 0.1° with maximum range of 200 m at 50% reflectivity, or 0.2 x 0.2° with 250 m at 10%. The InnovizTwo features numerous improvements over the InnovizOne, for example the range increases to 300 m, the field of view to 125×40° and the resolution to 0.07×0.05°. Innoviz claims a 30x improvement in performance and a 70% price reduction compared to InnovizOne— the price point is in the $500-$1000 range (https://www.prnewswire.com/newsreleases/innoviz-announces-another-breakthrough-in-lidar-technology–30x-performanceimprovement-and-embedded-perception-software-301267408.html).

OR: It’s part of transitioning from private to public. Part of it is that we had to comply with different SEC rules in having independent directors, but in addition, we brought strong talent, specifically of people who were on the boards of public companies. On the financial side, we had to staff the Audit Committee with people who had CFO-type experience in public companies. Our previous board was mostly venture capitalists who invested in us in earlier stages. We wanted to bring in new people, who would be independent directors as the SEC requires, and also would bring us value for the coming years.

LM: Let’s move on, then, to the products. You do both hardware and software. Would you like simply to give a description of your product line?

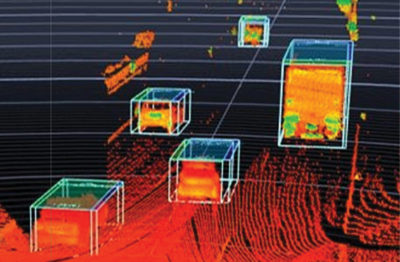

OR: We’re very focused on lidar and in addition to that the perception software that analyzes the point cloud. With respect to the target markets, it’s primarily automotive for us, but we’re starting to diversify into other applications. The first product, which is now ramping up to series production, is called the InnovizOne. The lead customer for that is BMW, but we actually sell it through Magna5, which is the biggest automotive tier 1 company in North America. We also work with other tier 1s, such as HiRain in China, Harman and Aptiv.

We just recently announced the InnovizTwo. The focus is primarily cost reduction, but we’re also improving the performance by quite a lot. But the focus is really on cost reduction. As you know, the expectation of lidar in automotive is a bit different from some of the applications that you guys look at, e.g. geospatial. In automotive, the price tag that the customers are looking for is more in the $500-$1000 range and that’s even going to go down. They can’t afford the lidars in the thousands, tens of thousands or even hundreds of thousands that are used in some of those mapping applications.

LM: One of those specifications I couldn’t find in your website is the weight of InnovizTwo?

OR: It’s just over 500 grams—530 or so.

In this example, there was a problem with bright sunlight (left), yet the data obtained using an InnovizOne (right) was not compromised and remained useful for vehicle navigation.

LM: Well, at that weight and at that price point I would have thought geospatial folks would be attracted. It’s typically integration companies that put all this stuff on to a drone—the lidar, the camera, the GNSS receiver and the IMU. They’re going to be salivating at that price point, and I think the range is plenty—you’re 250 m on InnovizOne and 300 m on InnovizTwo. You’ve put your finger on it, that there may or may not be an accuracy issue, because with automotive you’re trying to identify whether objects are there or not that could be a danger; with mapping you’re trying to get information about every pixel, if you will. The other point, typically, automotive-grade lidars are just noisier than the specialist ones. But at $500 you can put two of them on a drone!

Innoviz CEO Omer Keilaf holding an InnovizOne sensor astride the hood of one of the company’s R&D vehicles.

OR: Right. The thing is that they’re getting better, much faster than the specialist lidars because of the investments and the volumes. The accuracy we have today is not as high as those lidars used by geospatial applications. They get 20-30 mm accuracy and we’re more like 50-100, but we’re getting better. So, yes, we’re getting to the same kind of accuracy, and we don’t necessarily need to get the same range. They’ve got some units that can measure from 3 kilometers high. We don’t get there, but with some of the lighter drones you don’t need that. So maybe we’re not doing as wide a scan as they do, not necessarily, but I think that there are plenty of applications where what we do is actually good enough for drone-based mapping and just to prove that we recently started working with a few of those integrators that you mentioned. I can’t mention any names yet, but I hope that we will be able do some announcements soon on those collaborations.

LM: That’s exciting for our geospatial readers who—under my editorship, at least—are having to read more and more automotive stuff!

They need to know what’s leading edge, but if those integrators you’ve just mentioned are in the US, then we probably know them, so that’s exciting and we will look forward to that. I wouldn’t worry about range because the altitude of drones is governed by regulations in the US. It’s 400 feet, so you’re easily beyond that. That’s exciting, but let’s not spend the time talking about geospatial, because that’s not why you’re here! One of the specific technical questions that I had about the InnovizTwo is that it’s really good at working in poor weather conditions. Is there something specific about that, some technical development, so that it makes a particularly good job of that?

OR: It’s a mix. I think that probably the most important feature is to be able to detect multiple reflections. So even with the partially covered pixels, or if you get few returns in the same direction of shooting the laser, we can get up to three returns and they can be the three strongest—it could be the first, last and strongest or different configurations of those, but that allows you to go through fog or snow. Typically rain is not as bad as some of the other things. Dust is especially difficult.

LM: Strangely enough, one of the lidar companies I talked to early on in their development even had problems with very strong sunlight, but I think they’ve got through that.

OR: Well, that’s actually quite common. You’re shooting lasers at either 905 or 1550 nm and there’s a lot of noise from the sun at those wavelengths. So if you’re trying to identify the pulse that you sent out after it returned from an object, the noise that you’re trying to extract this from is sunlight noise. So if you don’t have sunlight, then it’s easier to detect returns, so typically lidars may work 20%, 30% better in terms of range at night versus at day.

LM: Your ISO 26262 compliance: I’m not too familiar with that, is that something that puts you ahead of the competition?

OR: Yes, that’s a distinguishing factor. ISO 26262 is a Functional Safety standard that’s used in automotive. It’s required if you’re designing a piece of hardware or software that’s somehow related to the safety of the vehicle. The automotive OEMs require that and it’s something you must do from the early stages of the design of the product. It’s being audited by the OEMs and, specifically in our case, also by the tier 1 companies like Magna. It definitely gets you to better safety and quality, but adds a lot of overhead to the development process. There are different levels in the standard: they’re called ASILs7—A, B, C and D. Our level is B of D, which means that we’re level B out of a D system. That’s difficult to achieve. I would say that almost none of our competitors meets that, and the reason we are able to do it, is because we’ve been working with Magna and BMW for more than three years now. Some of the other lidar companies that don’t have design wins for series production automotive programs haven’t started working on that.

LM: My next question is about the perception software. This is the Automotive Perception Platform InnovizAPP?

OR: Yes.

LM: So is that hardware and software?

OR: It’s both. It will be built into the InnovizTwo, so it’s going to run on a chip. It’s primarily implemented in software, but it can also run outside of the InnovizTwo. So in some cases, especially when some customers actually want to work with multiple lidars, they would typically take the raw data, the point clouds from all the lidars, and run the perception software in the central computer ECU8—so it depends on the architecture of the vehicle that the lidar is being used on. It either runs on the edge, which means it is running on the lidar, or it can run centrally on a separate computer, in which case we supply the software.

LM: Is that using deep learning or some other form of AI?

OR: Yes, a lot of the innovation in that field is in terms of functions like object detection and especially classification, trying to classify whether, for example, it’s a pedestrian or a car or truck or motorcycle or bicycle. Deep-learning algorithms have much improved and offer better performance than the traditional algorithms. We collect a lot of data and we also leverage our partners, such as Magna—they have vehicles in different countries since things look different in different countries. For example, lane markings look different, or you’ve got different cars, so they collect the data and they send us the data and then we train the algorithms. We also use separate datasets to validate the KPIs9 of those algorithms to see that we meet the requirements by BMW and then translate those into the software that’s running in real time in the vehicle.

LM: You said that you were implementing this partly inside the InnovizTwo. Typically people who work in this area have got some quite big hardware from Nvidia. You’re not going to fit that inside InnovizTwo!

OR: We actually have a partnership that we announced with Nvidia, for running our perception software in cases where it’s being used in the central ECU, but when it’s running inside the lidar, it’s actually using a chip from a different vendor, a lower power chip than those central compute chips.

LM: That’s pretty amazing though. You’ve got at least one, and maybe several inside different lidar sensors on a vehicle. That’s incredible progress in certainly less than 10 years, maybe even less than five. We start to take things for granted, particularly when we’re close to the technology, but if you sit back for a minute and think about it, that’s remarkable.

OR: I agree, generally in terms of the progress that AI made, and then, just specifically what’s going on in automotive. This industry has gone through such a tremendous change in the last few years in terms of electrification and autonomy, much more than it has gone through in the last 120 years.

LM: Absolutely right! It’s a very exciting time to be involved. The next question is do you use anything else? You focus very much on lidar and those are the exciting things you’re doing, but do you also use cameras, radar?

OR: We’re very focused. At least as of now, we develop lidars and we developed a perception software that’s running on the point cloud—we are not processing any image data or radar data.

LM: We’ve been through one or two stages in the geospatial world where some real enthusiasts said for a while, to make a map, you only need lidar, you don’t need photos anymore. I think, for the topography and so on, that’s true. For getting the real detail on a map, maybe not, but you don’t need that—you’re looking for different things. I don’t disagree with you. It’s quite interesting: you’re the opposite of Mr. Musk, who doesn’t use lidar!

OR: Let me just clarify. We’re not saying that you don’t need cameras and radars. We’re part of a system, for example, BMW uses our lidar and perception software. They fuse the raw data and they also fuse the high-level data, the object-level data from us, together with data that comes from the cameras and is being processed by companies like Mobileye, and data from the radars as well, so we strongly believe in sensor fusion. We think it’s necessary and we don’t believe that we’re competing with cameras and radars. We think that for achieving the level of functional safety that’s needed for autonomous driving, you must have the different modalities. We do the lidar parts.

LM: That makes sense. I’m talking to another company that just launched a unit that contains lidar and radar and cameras and they make the lidar and the radar themselves. They have a lot of stuff to develop and we’ll see how it goes. That gets me on to the next question, which is trying to understand the market. On the one hand, you get lidar sensor providers, people like Velodyne, Cepton and Quanergy, who basically make sensors, maybe an SDK and perhaps they’re starting to get into perception software. Then you get the people like DeepRoute in China, where they make a unit that basically sits on top of the car with cameras and lidars and they do some software. You do lidar, but you’ve got some very high-performance specialist hardware, firmware and software. How do you see that spectrum and where does Innoviz sit on it?

OR: We went up the stack ourselves. We do lidars, but we also went up to the level of perception software. We offer a very rich development toolkit, including drivers and SDKs. In order to use the lidar, we provide simulation software in partnership with Cognata. That’s the scope today. It is possible that in the future we will actually offer more software products and I mentioned sensor fusion earlier that we don’t do today, but we may do in the future.

LM: I see that and I also see the fact from what your announcements say, you’re actually manufacturing or you soon will be manufacturing at scale. And I know from talking to other lidar companies, that’s almost as big a challenge as designing the lidar in the first place.

OR: Even bigger. I didn’t really mention them as a product, but we also provide the manufacturing machines—we design the key machines that are used in the manufacturing of the lidar, which is completely automated. You could say that that’s part of the product. I think designing an automated production line is probably even harder than designing a lidar. People very often underestimate the difficulty. In high volume manufacturing, you want to keep the yields up and the costs down—that’s a lot of the focus now. We also leverage some good partners. We’ve been working with Jabil in Jena, Germany, for a few years now and in the last few months we’ve finished the ramp-up of a production line with one of our tier 1 partners.

LM: You have a production line in Michigan?

OR: One of our tier 1 partners has ramped up a high-volume manufacturing line.

LM: If we step back for a moment, the fully automated, the level 4 and level 5, hasn’t come yet in the sense that it’s not readily available, but there’s a lot of ADAS. Is that important at the moment to you as a kind of stepping stone?

OR: I think it’s very important. We’re also relevant for level 2+ autonomy systems, which you could call ADAS, because you still need the driver to supervise the driving. We don’t only go after the level 3 or 4 systems. The BMW system, for example, is level 3 and we work with some of the robotaxi and trucking companies that do level 4 systems. But there are also companies doing level 2+ systems. InnovizTwo, because of the cost reduction, is very relevant for level 2+.

LM: I think you’ve already answered the second to last question. Just the fact that you’ve already got a deal with BMW and several tier 1s means you’re ahead of some of your competitors. They’re getting into that situation, but they’re not as far forward as you are.

OR: Thanks. I would say so. I think we’re ahead of the pack, on a few dimensions. One is partnerships with tier 1s—the main competitors, jointly, have three partnerships and we have four major ones ourselves. We have the biggest and first design win for a level 3 system, the one with BMW.

LM: I think you’ve already given me more time than we agreed, so let’s finish with the last question. You’ve got InnovizOne and the perception software scheduled for production this year and InnovizTwo for this year. That’s a lot. How do you see your plans for the next couple of years or beyond?

OR: We’re ramping up very quickly now. Or I should say, continuing to ramp up quickly. We have teams here in Israel and also sales people globally. One big activity is to get InnovizOne into series production on the BMW cars, so we’re in the final stages of testing and integration. That would be a very major milestone—getting on the road in the BMW cars with InnovizOne—but at the same time we’re working on getting the first samples of InnovizTwo to customers by the end of this year. This will enable development based on InnovizTwo. I would say those are the main goals—getting InnovizOne into series production starting with BMW, then with others, and starting the engagements with customers around InnovizTwo later this year.

LM: That’s a challenge in itself. You’ve got a lot on your plate, but you’ve definitely got the team that’s going to be able to attack this. I’m very grateful for your frank answers and for being so ready to come and talk to us.

OR: Thank you very much.

2 Supplied by Innoviz amongst the company-related materials provided in support of this interview.

3 The SPAC route is proving an increasingly popular alternative to the traditional IPO (initial public offering). Velodyne Lidar chose this approach in July 2020 and we attempted to give some background in a related article, https://lidarmag.com/wp-content/uploads/PDF/LIDARMagazine_Walker-Velodyne_Vol10No4.pdf.

4 Private investment in public equity.

5 Magna International: www.magna.com.

6 Christensen, C.M., 2000. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail, HarperCollins, New York, 320 pp. This is one of many editions of this work. Christensen has authored several other books on the same theme.

7 Automotive Safety Integrity Levels.

8 Electronic control unit.

9 Key performance indicators.