We arranged to interview Velodyne Lidar’s new CEO, Dr. Anand Gopalan, in mid-January 2020—only ten days after Anand was promoted and founder David Hall moved up to chairman—but a family emergency cut short the trip. An in-person interview was precluded by covid-19, so we did it remotely. Anand was in his factory in San José, California, in the heart of Silicon Valley. While this article was being finalized for publication, Velodyne made a major announcement about combining with Graf Industrial Corporation. This is extremely important, so we have added a second, short piece to explain the news. First, the interview.

We arranged to interview Velodyne Lidar’s new CEO, Dr. Anand Gopalan, in mid-January 2020—only ten days after Anand was promoted and founder David Hall moved up to chairman—but a family emergency cut short the trip. An in-person interview was precluded by covid-19, so we did it remotely. Anand was in his factory in San José, California, in the heart of Silicon Valley. While this article was being finalized for publication, Velodyne made a major announcement about combining with Graf Industrial Corporation. This is extremely important, so we have added a second, short piece to explain the news. First, the interview.

Editor’s Note: A PDF of this article as it appeared in the magazine is available here.

LM: Anand, thank you for talking to us today. Now you are six months into the CEO post. Your previous time with Velodyne was three and a half years as CTO. What brought you to the company?

AG: I’d been in the Valley for a couple of decades, working on a variety of different technologies on optical transceiver products in many different spaces, such as automotive networking, and got a call out of the blue from Velodyne saying they were looking to start a research and development function. When I got started, it was three guys and myself in David’s boatyard in Alameda, not a real office, no drywall. I am an electrical and electronics engineer by training and have spent all my career doing that. I like to tell the story that my grandfather was actually an automotive engineer, in the automotive business in India. He tried really hard to make me an automotive engineer. I refused and became an electrical engineer. Then, all these years later, I come to Velodyne and am working on technology that’s finding a lot of applications in automotive. So it’s my dad’s turn to say he told me so! It’s been really an interesting journey and that’s how I came on board.

AG: I’d been in the Valley for a couple of decades, working on a variety of different technologies on optical transceiver products in many different spaces, such as automotive networking, and got a call out of the blue from Velodyne saying they were looking to start a research and development function. When I got started, it was three guys and myself in David’s boatyard in Alameda, not a real office, no drywall. I am an electrical and electronics engineer by training and have spent all my career doing that. I like to tell the story that my grandfather was actually an automotive engineer, in the automotive business in India. He tried really hard to make me an automotive engineer. I refused and became an electrical engineer. Then, all these years later, I come to Velodyne and am working on technology that’s finding a lot of applications in automotive. So it’s my dad’s turn to say he told me so! It’s been really an interesting journey and that’s how I came on board.

I’ve spent the past four years working alongside David, developing incredible technology, then talking to our big customers and learning about them deploying it across all their different applications, automotive and non-automotive, seeing how the technology was impacting their applications and how the applications were impacting society. It’s amazing to see your product on a vehicle as it drives.

David and I spent a lot of time thinking about technology strategy and business strategy over these years, which enabled the transition to CEO. We are still, first and foremost, a technology company. But it’s been a good transition and that’s been my journey.

LM: Your PhD was from Rochester Institute of Technology, in the area of RF data?

AG: Right. We were building radio frequency transceivers for many different applications. Those days, Bluetooth was the new “in thing” and we were building Bluetooth transceivers. I came to the Valley and worked on many different products and projects. I worked a lot on optical transceiver technology. I think that’s what attracted me to lidar, because essentially I’d been working on the communications side of things. Some of the first projects I worked on were such systems, bringing passive optical networking systems to the home. We were deploying the first fiber-to-the-home systems in Japan and Korea.

When I was called by Velodyne I looked at lidar—to some extent it’s a free-space optical transceiver. From that perspective, it’s been like coming full circle to the things that I had worked on before. We have taken some of the concepts and technologies that really made optical transceivers as ubiquitous as they are today and we’ve been able to apply them to mass produce lidar at scale, which is where we are as a company. There has been a natural progression to lidar, at least as far as I see it.

LM: That’s an interesting challenge. We did an interview with Cepton Technologies—I suppose they compete with you—and one of the points that they discussed is this issue of production scale, what you do in-house, what you outsource, how you find good firms to outsource to.

AG: These are very interesting challenges, especially because lidar until very recently was new and emerging technology without that much expertise in mass manufacturing. We’ve not only had to develop the technology into products, but also develop some of the key manufacturing methods to be able to scale it ourselves. Now we know that we have understood the manufacturing, we are better deployed with mass-manufacturing partners. I believe a lot of lidar in industrial and automotive segments is really a trade-off between high performance and manufacturability. You can build a very low-performance lidar that’s very easy to manufacture. But a high-performance one is usually very difficult to manufacture. I think that Velodyne has really spent its time and investment to find that sweet spot where you can get high enough performance and solve for the manufacturability challenges. The optical transceivers stuff comes in handy for sure.

LM: Absolutely. But are you still making subwoofers?

AG: No, not anymore. Velodyne Lidar has been a standalone company since 2016. And the acoustics brand was sold off to another company in 2019. So now we are no longer making subwoofers.

LM: I don’t want to spend much time on history, but I think you may have seen a book about the history of lidar by Todd Neff1. David Hall and Velodyne get a good write-up in there. In particular, how David saw an opportunity in the DARPA Grand Challenge in 2004. He put some stuff on a Toyota pickup truck and the rest is history.

AG: It’s the quintessential American inventor story. There’s an incredible challenge. At first no one succeeded, then David went away to think about the problem and came up with a unique solution. Then he tackled the DARPA challenge, as is famously told in the book. Five of the six contestants who completed the urban challenge had David’s lidar on them and it started off an autonomous revolution. It’s incredible that, even today, a lot of the participants in that Grand Challenge are very much still in the autonomy industry, in fact, in leadership positions across most of our customers. And of course, lidar has come a long way since then. It’s a vast array of form factors and applications all the way from something as big as the wheel on the top of the car to now something that’s tiny.

LM: It’s quite remarkable. I suppose I got into that because I noticed when I was coming to visit you in January that you became CEO and David moved to chairman at almost the same time that Steve Berglund at Trimble moved to chairman and Rob Painter became CEO, and Dr. Eldada at Quanergy Systems moved to a sort of consultant role. I guess that’s just private industry, isn’t it, particularly in Silicon Valley?

Velodyne’s microlidar array, an eight-channel lidar element with fixed lasers, detectors and ASICs developed in-house

AG: Exactly. I think that’s the nature of Silicon Valley. There’s lots of incredible talent, technical talent, leadership talent. The autonomous industry is a really dynamic industry. Even within the Valley, it’s probably at the cutting edge where everyone wants to work. There’s an incredible amount of talent in the space. We have been able to attract some great talent too. And so that’s part of it. And I think David is still an inventor at heart. He’s passionate about the technology, has a vision for the business and really wants to see his technology proliferate in all of these different applications. So as chairman he’s very much still involved from a vision perspective. Our customers are transitioning and the business is transitioning from providing technology for research and development projects, to being able to provide mass market technology to all these different applications that are actually going out into the field. That transition as a business requires a set of people to manage it. And David’s heart is inventing the technology and seeing the vision. So that’s why he made that the change [to chairman]. For some of the other companies in this space, it’s been a challenging time as well. Obviously, you’re seeing consolidation in the space. You’re seeing many companies die on the vine as well, especially in the harsh economic conditions.

LM: Yes, indeed—the CEO of Cepton said very similar words to me. I come from the geospatial world and was with Leica in 2001 when it acquired a company that was making airborne lidar systems selling at more than one million dollars each. It’s a different world. And so although that’s where our magazine has its roots, it’s interesting to report on automotive, because there’s a lot happening, the R&D pockets are deeper and so on. Indeed, the geospatial world has been the beneficiary of the contact with companies like yours, because it turns out that because of the enormous investment in R&D, you’ve been building lidar sensors that have become smaller and lighter—both attractive in the geospatial world. In particular, the sensors have reached the point where they can be mounted on UAVs.

AG: Three or four years ago lidar was really an autonomous vehicle and an automotive story, and automotive drove a lot of the initial investments in the space. But today, especially as form factors have gotten smaller, as ASPs [application service providers] have gotten much more accessible, you’re seeing this whole array of applications that are exploding into the commercial space Today lidar is not just an automotive story for us by any means. You’re seeing many different applications around small robotics, delivery systems, security systems, smart city applications, just moving into commercialization on the back of how attractive this technology has become. And now they’re as much volume drivers for our business as automotive. That’s been the other sea change that’s happened. The unfortunate situation with covid-19 has actually accelerated some of these applications, where many of our customers are creating cashless delivery systems, robotic systems that can help in communities, do things like disinfection, delivering medical supplies and so on. That whole trend has accelerated the acceptance of small robotics in society and lidar is playing a key role to make those systems successful. It started off with automotive investments driving the miniaturization of the technology, but today many different industries do so, including the geospatial world. All these other industries are benefiting and scaling quite rapidly today. We are very excited to see the growth not just in the automotive space, but actually far more in the small robotics space as well.

LM: I think there’s a parallel there—small integrators in the geospatial world, such as LiDAR USA, Phoenix LiDAR Systems or YellowScan, again full of very talented people. They’ve brought sensors like yours into the hands of UAV users, companies that offer UAV-lidar services. And I’m sure in these other applications that you’re talking about, such as automated delivery systems, similarly, very impressive integrators have been leading the way.

AG: Very much so. I think you’re seeing some of the very big players in the space want to use these smart solutions developed by these integrators, incorporating lidar to solving some of their big delivery e-commerce challenges. Definitely that’s a trend that’s cutting to accelerate across the board for sure.

LM: So we come to the Velabit product, which you announced at a price point of one hundred dollars. As I said, I started in a world of million-dollar airborne sensors. So there’s a bit of a difference—four orders of magnitude. Tell us a little bit about that and about the technology, the miniaturization and then also the application of Velabit.

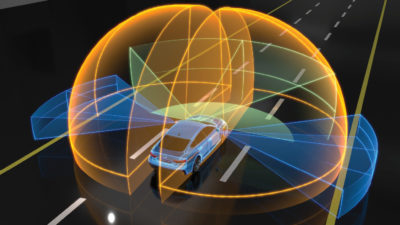

AG: Velabit is a culmination of a lot of work that we have done over the past four years around bill of materials, integration, miniaturization, and then just bringing efficiencies of scale. We have been developing our own lidar ASICs—application specific integrated circuits for lidar—for about four years. This has allowed us to collapse the entire bill of materials for lidar into a couple of pieces of silicon and drive huge benefits from a bill of materials, cost and reliability standpoint. The other thing driving miniaturization as well as automation is the act of putting a lidar together. There is a technology that we call the microlidar array, which is really an array of lidar elements that we’re putting together in a fully automated fashion, effectively creating the ability to miniaturize multi-channel lidars and create form factors that are very persuasive. Just to give you a sense, what I’m holding in my hand is an eight-channel lidar element which has fixed lasers, detectors and our own ASICs. It’s put together in a completely automated fashion. These technology investments we have made over the past four years really have come to fruition. Within the development concept, it was an attempt to say: if you wanted to build the smallest form factor, most affordable lidar that was still usable in outdoor, automotive-grade applications, what could you come up with? That’s what we’re going for! Velabit is compelling, with a tiny form factor. And then it has this microlidar array technology. It really has allowed us to break open of a variety of new applications around lidar.

There’s many interesting conversations happening. In the context of automotive, up until now, we’ve gotten lidars to a few hundred dollars, where the automotive OEMs were thinking about lidar as still starting off in the luxury car segment. Think of a highway autopilot, that kind of functionality enabled by lidar. And then eventually, as the prices come down, it makes its way into the big tier and the lower tier segment. But what we’re able to do with something like Velabit is say—I’ve already jumped. I made the quantum leap to give you something that’s so attractive from a cost-point perspective that you can afford to put a couple of hundred dollars of lidar plus compute content even in a mid-tier car. With this technology, in conjunction with our software, you’re now able to get vastly improved functionality on something like pedestrian and bicycle collision avoidance. For example, there was interesting work by IIHS2 and AAA3 last year. They were testing all the automatic emergency braking systems that are available across many different standard cars today. They found that, for many of the cars, the systems barely worked in daytime and did a very poor job of detecting pedestrians and bicyclists. And they never worked in the night. And, you know, that means if you are driving around in the night, you have huge risk that the systems completely fail because they have no ability to detect in the night as they’re all camera-based systems.

Now you have this massive, quantum leap in the robustness and reliability of the technology. So the interesting conversation we’re starting to have in the automotive space, with many of our customers, is: think about the fact that you have one-hundred-dollar lidar content plus some compute and software. Can you imagine what you could do, even in a mid-tier car, to make the car much safer for the occupants as well as for the general public around them? Those very interesting conversations have started because of development. And then, of course, in non-automotive the possibilities are limitless. We are seeing customers come up with many applications we haven’t even imagined because they are enabled by the contractor and the cost-point of the technology. So developments are seeing an explosion of interest and are driving lots of interesting discussions around new applications for lidar.

LM: I think that, in the geospatial world, there are still some companies reluctant to put lidar on UAVs because of the cost. Even your eight-thousand-dollar Puck is a little bit of a worry to put on a five-thousand-dollar UAV in case it crashes! You could put a couple of one-hundred-dollar lidars on and not worry about it. It could be that people like LiDAR USA will be on the phone to you quite soon and say, let’s try some of these, because it’s got a 100-meter range. That’s easily good enough. That means that you can fly almost at the regulatory maximum height and that sensor will still work.

AG: Exactly. So we’re definitely seeing a lot of interest from the UAV space, for that exact reason and also it’s a very light sensor, so from a mass perspective and battery life perspective, it’s pretty attractive.

LM: Yes. You don’t need a five-thousand-dollar DJI Matrix. You can go for something, maybe a thousand-dollar price-point. I think that will make a difference because nobody else has really got anything just there at the moment. Congratulations. So we covered Velabit then you touched on the VELARRAY. And that was going to be in my next question, how that fitted in. Now you’ve got software too, and I suppose in order to gain market share, because it’s a very competitive world, as you said, you need to be able to offer solutions. Solutions require software. I see Cepton, Quanergy going that that way. I see SICK in Germany going that way. And you’re doing the same.

AG: There’s two ways to think about the software itself. One is, of course, there are applications for lidar outside traditional automotive, where the customers are really looking for a hardware-software solution. They feel that the lidar provider can add much more value because they understand the output of the sensor much better. Even in the automotive context, especially for driver-assistance system applications, we are seeing customers want a more complete software solution, because we understand the lidar that much better. And we have the entire solution of how to drive intelligence and value from the lidar. We acquired the small software supplier mapper.ai in 2019. And that’s allowed us to really accelerate and bring to market effectively a suite of software that’s ready to go, this year. So definitely that’s a key element. And obviously, as the leader in this space with the broadest installed base of our technology, we think we’re well suited to leverage our software to be able to effectively increase our monetization of the technology. Software is a great addition to our hardware technology and gives us lots of growth.

LM: So we’ve talked then about the Velabit, the VELARRAY. You’ve now got quite a large, complex product line. I think you’ve got six pucks, two XDLs, VELARRAY and Velabit. Do you want to say something to put them in context?

AG: The breadth of product portfolio is a key part of our strategy, because all the different applications we serve cannot be satisfied with a single technology. There are so many different types of lidar needed for so many different applications. As we try to solve all these different applications going into commercialization, we have come to the recognition that there is a need for a broad portfolio. Many of our customers are big, marquee, blue chip companies which have many different needs for lidar and our ability to have this breadth of the portfolio allows us to serve these customers across all the different applications. So if you see level four, level five autonomy, you still see the rotational 360° surround-view lidar, often roof-mounted, as being the reference architecture. So we continue to see traction for level four, level five systems. Now, if you look at small robotics or if you look at it ADAS [advanced driver-assistance systems] applications for consumer vehicles, then of course the solid-state directional lidar is preferable. Again, we have a broad portfolio going from the Velabit to the VELARRAY to cover that space very well. And then we have other architectures like the VelaDome for commercial vehicles and so on. The breadth of the portfolio has helped us and we leverage that to be able to serve our customers well across all the different lidar needs.

LM: It makes sense, but it’s hard keeping all these products—the product management is a challenge.

AG: That’s definitely something that we continue to work on and think about a lot. There’s a strategy to this: we have created a common core set of technologies that drive into all of these different product architectures. That’s what allows us to be able to get economies of scale and leverage it. Imagine common base elements, common supply chain, even common manufacturing methods for a lot of the subsystems, common signal processing techniques and firmware, and common ASICs that work across all these different products—that’s allowed us to create the breadth of the portfolio. These are not eight point-solutions that have been put together. It’s actually one continuum of product architectures with common core technology elements that are across this entire family.

LM: Preparing for this conversation, I went through your website and there are numerous press releases of different kinds. But I want to home in on your strategy for sales, in other words, developing a sales channel as opposed to doing direct sales from the Valley. You talk about Emesent, which we know quite well in the geospatial world. There’s the NavVis VLX, an indoor mobile mapping system. There’s your relationship with GeoSlam. So some of these are technical. And then some of them, for example, Agrointelli, are sales agreements. So maybe you could talk about your sales strategy and sales agreements. And then we’ll talk about the Automated with Velodyne program.

AG: The common thread is a series of industries that are at an inflection point, going from what I would call the research and development phase to the commercialization phase across many different applications. There’s two things we want to do. We want to continue to seed our technology into new and emerging applications for the usage of lidar. That’s what we have been doing for many years. And we continue to do that both directly in the case of some customers and through our sales distribution partners in many cases as well, on a worldwide basis. So we have both direct sales as well as distributor relationships in all major geographies. But a lot of this seeding activity over the past four or five years is now coming to fruition with many of these technologies effectively moving into the commercialization phase. And often there, as in the examples that you quoted, we are now establishing these direct long-term relationships with our customers. We are able to support them as they walk the walk towards mass-market adoption of their technology by providing them the lidar and, in some cases, the software that allows them to scale this in the most cost-efficient manner. A key portion of the strategy is being able to create these long-term relationships with customers as they scale. That allows us to provide them the technology that scales with their application—at the right price-point, of course. Broadly speaking, that’s how we do it. It’s obviously true in North America, Europe and the Middle East as well as in Asia-Pacific.

LM: There’s so much going on over and above the technology development, which I guess was where you came from, but there is clearly other expertise in Velodyne on the business side, looking at this relationship-building over the last five or 10 years.

AG: The company, of course, has been the first mover and the incumbent for over a decade and has very long-term relationships with many of these customers. And there’s people in Velodyne who have built those relationships, for a decade plus. That is key because I think we have had a track record of being able to deliver this technology into these customer applications. That creates a very deep trust relationship with our customers, which allows them to have the confidence that, as we move to this next phase of lidar adoption, we will be able to continue to scale and meet their needs.

LM: On the technical side, then, as opposed to the sales and distribution side, you’ve introduced the Automated with Velodyne program4, announced in April this year.

AG: Broadly speaking, this dovetails into the strategy that I was just telling you about. We believe that when we’re able to partner deeply with the customer, enable their end application, as we do with the Automated with Velodyne program, and then, in many cases, co-market that application and bring it to their end customer together, then we are able to drive adoption of the technology much faster. The co-marketing efforts, as well as the education efforts around the technology, increase and speed up societal acceptance of the customers and technology. The Automated with Velodyne program allows us to be able to deeply engage with our customers on these activities and accelerate the adoption of their end technology into their markets, which obviously is a great benefit to us as well.

LM: Yes, that will be an interesting program that will grow and grow as time passes.

AG: I am very excited about the fact that we already have a significant number of customers—more than 50, I think. We are seeing a lot of customers approach it with great enthusiasm and sign on to be part of it. It’s created a very nice ecosystem around the lidar technology.

LM: Well, the next question, it’s unfortunate that I have to ask this, is about covid-19. I attended a webinar run by the organizers of the Intergeo trade show and conference in Germany, about what various companies were doing to try to help the fight against covid-19. So I presume Velodyne is involved as well.

AG: We are seeing a lot of our customers, especially in the small robotics space, develop and deploy solutions to help communities to deal with these issues. We have a customer developing disinfecting robots, as an example. We have many customers developing touchless delivery services so medicines, goods and groceries can be delivered into communities that are affected. We have seen such applications in North America. We have seen such applications in China, when the pandemic first hit. It’s been incredible to see how the customers—in some cases their technology was still in early R&D—were able to accelerate the march to production and deploy these technologies in many of these communities. As Velodyne is supplying the eyes of these machines, so to speak, I’m really proud to be part of that effort to help communities as best we can. So while it’s been, of course, a challenging time for all businesses, including ours, this has kept us very passionate and motivated, seeing our customers coming to the forefront in many of these different applications. That’s definitely the silver lining.

LM: Yes, indeed. I was impressed reading your your website, you’re obviously intensely active, with expansion, growth in markets, growth in partnerships, growth in product range. How do you see things going for the rest of this year and then in the future?

AG: Yes, we are we are seeing a tremendous growth in markets. We are seeing an ability to have this broad product portfolio and ship product at scale really help move our customers into a mass commercialization phase. I expect that trend to continue across many different applications, automotive and autonomous vehicles being just one of them. You will see many of these applications come to market around the usage of lidar and that’s really driving a lot of growth for the business and a growth in the customer base. As this continues, it will be a very exciting, intense and busy time for us as a business. And I think we will continue to grow and serve a broad base of customers to the best of our ability.

LM: Now, I completely understand that you don’t want to answer any questions about your financial numbers because your company is privately held. Can you say anything at all about the number of employees?

AG: We have about 300 employees.

LM: 300 employees is big in the world of lidar! Your company is growing, so the number of employees is growing and the influence that you will be having on offshore companies to which you outsource manufacturing is growing. That’s all good news.

AG: Yes, very much so. And I think we will continue to expand our footprint globally and impact both directly and indirectly all these different companies which are working with us, buying our product, manufacturing our product and supplying subsystems into our applications. So I think it’s a pretty exciting time for the lidar business in general. And definitely we are seeing that also for ourselves.

LM: Well, congratulations on your accomplishments in the state of the company today. Thank you very much for giving so generously of your time. I really appreciate that. As I said, for a magazine such as ours to gain access to C-level executives in a leading company is much appreciated.

AG: Thank you very much for your thoughtful questions and for the conversation.

1 Neff, T., 2018. The Laser That’s Changing the World, Prometheus Books, Amherst, New York, 314 pp.

2 Insurance Institute for Highway Safety: https://www.iihs.org/topics/advanced-driver-assistance.

3 American Automobile Association: https://www.aaa.com/AAA/common/aar/files/Research-Report-Pedestrian-Detection.pdf.

4 Jon Barad, vice president of business development at Velodyne, pointed us to this blog for further information on the program: https://velodynelidar.com/blog/automated-with-velodyne-ecosystem-video/.