Geodetics, Inc. is a technology company based in San Diego, California. Its visionaries are scientists who are experts in geodesy and GNSS/IMU integration. Indeed, they have contributed three articles to LIDAR Magazine1,2,3. Founded with commercial markets in mind, the company next prospered as a defense contractor and has always been willing to diversify. When UAV systems for photogrammetry and lidar entered the market-place, enabled by Part 107, its time had come. Managing editor Stewart Walker visited Geodetics to find out more about the company’s path through the years. Here is what he discovered.

Editor’s note: A PDF of this article as it appeared in the magazine is available HERE.

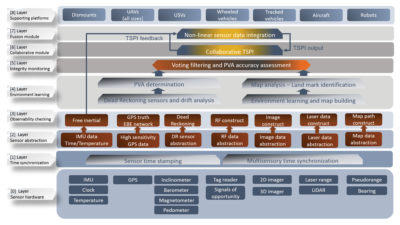

Figure 1: Geodetics’s multisensor integration architecture. This schema of the company’s multilayered approach helps explain how it can apply its expertise, starting from its GNSS/IMU roots, to a broad range of applications.

Geodetics’ beginnings and the forces that directed it

Geodetics, Inc. is housed in an industrial park tucked between La Jolla and the Pacific Beach and North Claremont neighborhoods of San Diego, just to the east of the I-5 freeway. I was hosted by president and CEO Dr. Lydia Bock, vice president business and product development Dr. Jeff Fayman, and chief navigation scientist Dr. Shahram Moafipoor.

Fayman provided a succinct history of Geodetics. The company was founded in 1999 with the idea of assembling a group of scientists from academic settings in precise GPS positioning to develop products and services for various civilian markets. Their field was geodetic science, hence the name Geodetics. One of their early endeavors was CR-NET, a reference network monitoring system for large GPS networks, the first of its kind in the world and still in use today. In 2000 the US Department of Defense became aware of the company. DoD’s staple pursuit was ever higher precision in positioning, navigation and timing (PNT), for anything that moved, whether on land, at sea, or in the air—including, as time passed, UAVs. Geodetics gradually transitioned, therefore, into defense technologies, expanding from algorithms and science to various turnkey systems. The foundations of PNT are GPS, GNSS and IMUs. Accepting that many companies do similar work, Fayman argued that Geodetics’s unique contribution is to exploit its GNSS/IMU core competence as the foundation of larger capabilities. Interesting applications include systems for relative navigation, mobile mapping, sensor fusion, GPS-denied positioning (Figure 1). GNSS/IMU is the expertise, but that’s just the starting point.

Market diversification

As time went by, Geodetics’ products evolved into turn-key hardware and software navigation solutions. In 2008, moreover, defense expenditure waivered due to sequestration. Geodetics, therefore, decided to diversify its portfolio to ride the vicissitudes of defense funding. An emerging market became part of the vision: the prices of UAVs were falling and their use was becoming more widespread and no longer restricted to defense applications. Fayman felt that part of AUVSI’s territory had been ceded to Commercial UAV Expo, a sign of increasing UAV activity in the commercial world. Then they saw a sensor that had started to become reasonably priced—lidar! The downward driver on prices, of course, was autonomous vehicles (AVs), i.e. vehicle manufacturers were investing heavily in the development of lidar technology and the large volumes facilitated economies of scale. Geodetics was able to piggyback on these trends. But the real “game changer” was the transformation of the FAA regulations with the introduction in 2016 of Part 107 to manage the use of UAVs in civil airspace for commercial purposes, whereas the process for waivers and exemptions under Section 333 of the FAA Modernization and Reform Act of 2012 had been rather unsatisfactory since the first approvals were granted in 2014. This trifecta of lower cost UAVs, lower cost lidar, and a more appropriate regulatory environment enabled Geodetics to prosper: mushrooming UAV applications would be the hedge against fluctuations in the defense industry, so Geodetics invested heavily in building out the Geo-MMS product line, the company’s mobile mapping system. Geo-MMS started as UAV-lidar only, but expanded to include photogrammetric image acquisition with low requirements for overlaps and sidelaps, including RGB and multispectral sensors to enable colorized point clouds. The company’s roadmap includes hyperspectral and other sensors, for example for methane detection. The company considers to be within its ambit applications that previously were prohibitively expensive, such as BIM, surveying, oil and gas, environmental, infrastructure, forestry and archaeology.

Figure 2: Fighter aircraft refueling from Boeing KC-46 air tanker. Geodetics provides the relative navigation system, including GNSS-denied capabilities.

While Geodetics successfully moved into several of these markets, defense budgets recovered and the company’s defense business has taken off too. The company benefits from cross-pollination between them and technologies can be used in both. Lidar has been integrated on UAVs operated by US defense forces. Working in the GPS-denied and autonomous vehicle navigation areas are other big markets, where Geodetics uses multi-sensor fusion as the keystone of its solutions. One of Geodetics’s claims to fame is its success in relative navigation for mid-air refueling (Figure 2) and autonomous ship-board landing. These solutions are based on GPS, but it can be replaced when the need arises by other sensors that can generate relative positions, for example lidar or cameras.

Figure 3: Geo-MMS LiDAR product mounted on DJI M600 UAV. Clearly visible is the two-meter carbon fiber boom of the dual-antenna interferometer for estimation of heading, with GNSS antennae mounted on each end. Above the aircraft are three more GNSS antennae. Below the aircraft is the Velodyne VLP-16 lidar sensor (Geodetics can supply other sensors according to customer requirements), behind which is the cuboid shape of Geodetics’s Navigator system.

The crux of the company

Bock’s PhD was in material engineering at MIT, but her master’s was in civil engineering at The Ohio State University, where she was exposed to the university’s excellence and vibrant activity in geomatics. After graduating, she worked for Raytheon then SAIC, i.e. leading defense contractors, before founding Geodetics. It briefly occupied an office on Pearl Street, La Jolla, before moving to its current location, which was selected as it was near the center of gravity of the principals’ homes and because there was access to the roof to mount the antennae and other equipment that would be needed for GNSS work. The company was able to double its space, two years after moving in, by adding the office next door and has up to 30 employees—the number grows when there’s a need to manufacture for defense contracts.

Figure 4: GeoPhotomap. In this view, the Sony camera, mounted below the Navigator system, is pointing horizontally for tower inspection, but the user can rotate it to the vertical for nadir scanning in seconds.

Fayman, a San Diego native with BA and MSc degrees from San Diego State University (SDSU) and a PhD in computer science from Technion Israel Institute of Technology, joined the group in 2001 and Moafipoor, who earned his PhD in geodetic science from The Ohio State University. The company is privately held, so it can work on whatever it finds interesting. The foci are innovation and new products that take science into the real world. The team consists of scientists, i.e. their profession gives them a major advantage over GNSS/IMU integrators or, indeed, less able firms that just package lidar with UAVs.

Figure 5: Point&Pixel, which includes both lidar and camera. This close-up view shows, from left to right, the two-rail system with clamps to accommodate the boom of the dual-antenna interferometer; the Navigator system mounted rigidly to the rails; Velodyne VLP-16 lidar sensor, mainly hidden behind the Navigator; and Sony camera in vertical position. Point&Pixel is also available with a multi-spectral option.

We probed this more deeply, exploring how Geodetics differs from other players. Fayman explained that Geodetics was one of the first developers of epoch-by-epoch RTK. Bock explained the role of Geodetics in the development of the RTK approach to GPS positioning, using the lambda method developed by Professor P.J.G. Teunissen at Delft University of Technology in the 1990s. The company developed epoch-by-epoch RTK for kinematic ambiguity resolution, its own variants of the Kalman filter and relative extended Kalman filter, and the tight coupling of sensors. Geodetics builds its own hardware and argue that it exploits the rawest form of data from the sensors and molds it to create the optimal solution: it gains flexibility by working with the raw GNSS measurements, not the position computed by the receiver; thus it is immediately above the sensor, GNSS and IMU manufacturers in the food chain. Bock said, “The idea of our building this here is that it gives us flexibility, adaptability, and the ability to innovate.” Fayman exemplified, “We can respond to our customers. If they have a question about Kalman filter tuning, who better to ask than the people who developed it?” When customers see Geodetics’s Assured PNT suite of defense products and request changes, Geodetics can deliver. Geodetics purchases sensors, as well as GNSS and IMU components, from their manufacturers.

Figure 6: A few of the members of the PNT Assured family of commercially available products for defense customers.

The company has plenty of customers now and has enjoyed significant growth over the last few years. It continues to improve and respond to feedback from customers—new ideas are implemented every month. Fayman concurred, arguing that the UAV/lidar/sensor-fusion market is a large one, for which competition is a boon, ensuring good products at lower prices. Geodetics experienced its pain 15-20 years ago, when it began in GPS/IMU, so it has extensive experience. It wants to bring more capabilities to its customers, through better products at lower prices, while continuing to innovate. The scientists communicate energetically, using academic journals4 as well as vehicles such as LIDAR Magazine.  Indeed, they have a blog site (https://geodetics/why-geodetics/blog/) to encourage the two-way communications. Bock emphasized, “We want our customers to feed back, so we can accommodate them.” Fayman referred to the dichotomy of defense and commercial development cycles, the former needing innovation continuously and the latter, rather slower. He quipped, “In the commercial market, if it’s shipping it’s obsolete. In defense, if it’s in initial design review, it’s obsolete.” The Geodetics team enjoys defense business, with its interesting applications and the sense of supporting the nation’s military, but conceded that the commercial UAV business is fresh and stimulating, full of potential.

Indeed, they have a blog site (https://geodetics/why-geodetics/blog/) to encourage the two-way communications. Bock emphasized, “We want our customers to feed back, so we can accommodate them.” Fayman referred to the dichotomy of defense and commercial development cycles, the former needing innovation continuously and the latter, rather slower. He quipped, “In the commercial market, if it’s shipping it’s obsolete. In defense, if it’s in initial design review, it’s obsolete.” The Geodetics team enjoys defense business, with its interesting applications and the sense of supporting the nation’s military, but conceded that the commercial UAV business is fresh and stimulating, full of potential.

Geodetics, furthermore, has discovered local synergies. There is a manufacturer of multispectral sensors across the street from Geodetics, as well as two AV companies. Geodetics feels some excitement about automotive applications, for which the company’s special skills position it very well. We talked about creative market players such as Cepton, Ouster, Quanergy and Velodyne LiDAR. Solid-state lidar is central in automotive applications and is coming to UAVs. Geodetics admires the capabilities of these companies as well as mainstream sensor suppliers such as SICK, FARO, RIEGL and Teledyne Optech. Moafipoor added, “We like all these laser companies and one of our jobs is, every day, just checking out their sensors.” Geodetics was disappointed not to be involved in the DARPA Challenge events more than 10 years ago, which were such a catalyst in the development of lidar for automotive purposes and, as a result, for more efficacious TLS and MMS applications. Fayman reiterated, “It’s changing all the time and all the companies are getting better every day.”

Geodetics, furthermore, has discovered local synergies. There is a manufacturer of multispectral sensors across the street from Geodetics, as well as two AV companies. Geodetics feels some excitement about automotive applications, for which the company’s special skills position it very well. We talked about creative market players such as Cepton, Ouster, Quanergy and Velodyne LiDAR. Solid-state lidar is central in automotive applications and is coming to UAVs. Geodetics admires the capabilities of these companies as well as mainstream sensor suppliers such as SICK, FARO, RIEGL and Teledyne Optech. Moafipoor added, “We like all these laser companies and one of our jobs is, every day, just checking out their sensors.” Geodetics was disappointed not to be involved in the DARPA Challenge events more than 10 years ago, which were such a catalyst in the development of lidar for automotive purposes and, as a result, for more efficacious TLS and MMS applications. Fayman reiterated, “It’s changing all the time and all the companies are getting better every day.”

Figure 7: The two-rail system that enables the Geo-MMS systems to be rigidly mounted on either a UAV or a ground vehicle.

Geodetics uses Velodyne lidar sensors (Figure 3), which it regards as providing a good value for the company’s target markets and is currently adding several new LiDAR sensors to its product line including Quanergy and Optech. Numerous GNSS and IMU components are available for consideration for each project or product, the range being all the greater because Geodetics uses the GNSS sensors as measurement engines and process the raw data with its own GNSS/Inertial algorithms. One of Geodetics’s recent additions is the use of dual-antenna interferometers for the estimation of heading on its Geo-MMS product range. Cameras are a relatively new addition and the product range reflects this with the addition of Geo-Photomap (Figure 4) and Point&Pixel (Figure 5). The rationale is to use precise positioning to reduce the need for ground control points and large overlaps, i.e. to make the UAV data acquisition mission more economical in terms of greater coverage per battery. MSI imagery is used to colorize the lidar point cloud or generate orthophotos. Geodetics has found a company that offers an MSI lens for existing cameras that they already sell with RGB. “Everything is modular now,” explained Bock. Much as Geodetics has been proselytizing its off-the-shelf Geo-MMS product line, the company builds to order if that is what the customer requires. They received many requests for MSI and colorized point clouds, so it was natural to add these features. “We’re bringing these particular capabilities to a market that’s just opening up—drones,” confirmed Fayman. “The applications are just going to continue to grow and we will continue to add capabilities.” Since they start closer to the sensor and write their own software, they are well placed to be flexible. “We’ve found our niche here in San Diego and we enjoy what we do,” enthused Fayman. “We are a very happy company,” agreed Bock. “We don’t have debt.”

The geodetics team reflected fondly on their mid-air refueling triumphs. There are applications in both commercial and defense. Autonomous ship-board landing is but a step further. They continue to supply products to their military customers for all sorts of applications. They write complex proposals. Often they participate by responding to RFPs from prime contractors. “We have our feet in both realms,” said Fayman. As noted above, the applications are growing in number and are becoming more and more interesting. The company’s revenue stream encompasses both defense and commercial. The balance or mix changes through time. “Both markets are expanding and the boundary between them is gray—they are really converging, these two markets,” said Bock. “Defense is moving to using our commercial products.” This also ensures more rapid development.

One of the reasons Geodetics located in San Diego was a wish to work with UCSD. The company also collaborates with San Diego State University (SDSU), where its work with Professors Allen Gontz and Tom Rockwell in the university’s Department of Geological Sciences department has earned considerable publicity5. SDSU contacted Geodetics, not far from the campus, for help in applying geodesy to earth sciences. The area of interest was the San Andreas Fault and the goal was to identify precursors of earthquakes. Geodetics went out with the university team and performed a precise lidar survey at the very end of the Fault, in the area of Mecca, California, on the northern shore of the Salton Sea. Geodetics has consequently been invited to do further work in several countries.

The products today

The Assured PNT family is Geodetics’ commercially available product line for defense. It includes multiple GNSS/IMU solutions focused on particular applications, for example Geo-APNT, Geo-iNAV, Geo-RelNAV, Geo-hNAV, Geo-Pointer and Geo-TRX (Figure 6). Geodetics offers them to defense customers with SAASM and P(Y) capabilities and is ready for the forthcoming military (M-code) GPS.

On the commercial side the product offering is the Geo-MMS family, i.e. mobile mapping, consisting of Geo-MMS LiDAR, Geo-Photomap, and Point&Pixel (Figures 3, 4 and 5). This family is growing, of course, since its main market is UAVs.

The company also offers a number of software products, such as RTD-Pro, the current incarnation of the CR-NET mentioned at the beginning of this article.

A support engineer at Geodetics brought some products into the room for me to admire. Moafipoor showed me Geo-MMS LiDAR, emphasizing again how important it had been over the years to refine the products in response to customers’ feedback. They call their electronics box the Geo-MMS Navigator. It contains the GNSS receivers, IMU, radio and various subsystems. “The difference,” Jeff reminded me, “is that we build the electronics that go into it—we don’t buy them from a GNSS/IMU supplier.” The goal is easy data collection. The system weighs 5-6 lbs. including two-meter boom, mounting assembly, Geo-MMS Navigator, lidar and camera, so they use the DJI M600 Pro UAV and other high lift capacity drones are available. Moafipoor, pithily referring to the output as “image with attitude”, described the system as a “piece of art”, a brilliant combination of components, beautifully integrated with the UAV. Data are downloaded to a MicroSD card and can be ready for use 20 minutes after flight. Geodetics also has a real-time capability: they download what they regard to be of greatest value to the user, i.e. a point density map, showing the density of lidar collection as it varies across the project area. The user sees this being built up as the UAV flies, assesses whether the mission goal has been accomplished, or decides on a further flight while still in the field. Geo-MMS includes its own mission planning software, so there is no need for their users to purchase licenses for third-party products. There are no annual license fees, because Geodetics develops the software and doesn’t have to pay third parties. Geo-MMS starts below $50K, surely economical given the expertise embodied in it.

Fayman mentioned calibration of the Kalman filters, but they have eliminated most of that via by the dual antenna interferometer. This involves a 2 m folding boom, made of carbon fiber, fixed to the UAV at any direction relative to the flightline. The GNSS antennae at its ends, plus the software, enable the UAV’s heading to be estimated very accurately indeed, starting before take-off. The Geodetics team was adamant that the system does not change after factory calibration. Thus the customer has minimal need of special flight patterns for calibration purposes. The UAV has two rails, the relationship of which to the UAV is calibrated in the manufacturing stage (Figure 7). This is like determining the lever arm and boresighting of the rails, all in the factory with little for the user to do. The payload is rigidly attached to the mounting assembly, which in turn is rigidly attached to the calibrated rails. Hence the payload can be changed but, owing to the rigid connectivities, the calibration will not change. Geodetics has is proud of this intriguing feature, the culmination of many years of intense work. Fixing the boom to the UAV is very simple (Figure 5). The user can switch the UAV’s camera from horizontal to vertical in seconds. The UAV just takes off and the Kalman filters work! Indeed, Geodetics uses the same rail system on its vehicle mount, so the same principles extend to data acquired on the ground. It is possible, therefore, to remove a payload from a UAV and attach it almost instantly to a vehicle. Geodetics flies UAVs over a calibrated test field near its office and has confirmed the constant state of the calibration—the firm has the courage of its conviction that is has found the ideal mechanical solution, so that the relationships between the navigation system, the lidar and the camera stay the same.

Altogether the system has five GNSS antennae (Figure 3). The Geodetics solution is autonomous with respect to the aircraft’s autopilot, not reliant on the UAV manufacturer or the GNSS being used to control the UAV. The latter flies way points—that’s all. Geodetics uses its own high-end dual-antenna interferometer and high-end IMU. Fayman reiterated the advantages of the boom: heading known before take-off and known calibration mean minimal need to turn Kalman filters in flight, saving precious minutes of battery life. This independence of the Geodetics solution from the UAV means they can easily fit their system to US-built UAVs as well as those from China.

Geodetics—the future

The firm’s future directions include further innovation and more UAV markets, both defense and commercial. The UAV revolution provides opportunities to address new applications as well as provide more economical solutions for existing ones. As UAVs proliferate, Geodetics will endeavor to remain in the forefront. The scientists will exploit new technologies and inventions. They will continue to demonstrate their class by publishing academic papers. The company anticipates an exciting future.

1 Moafipoor, S., L. Bock and J.A. Fayman, 2017. LiDAR/camera point & pixel aided autonomous navigation, LIDAR Magazine, 7(7): 36-47, October/November.

2 Nagarajan, S. and S. Moafipoor, 2017. A new approach for boresight calibration

of low-density lidar, LIDAR Magazine, 7(8): 40-43, December.

3 Moafipoor, S., L. Bock, and J.A. Fayman, 2018. Realizing the potential of UAV mapping, LIDAR Magazine, 8(6): 40-45, November/December.

4 For example: Moafipoor, S., L. Bock and J.A. Fayman, 2017, Autonomous UAV navigation based on point-pixel matching, ION Pacific PNT Conference, The Institute of Navigation, Honolulu, Hawaii, May 1-4, unpaginated CD.