For the last six years, I have been writing this “Top Geospatial Trends” column, which is usually published in January or February. Some years, the columns write themselves, as advancements in the industry emerge or innovative perspectives demand input and conversation. This year, because the industry is still working to shake off the dust from the pandemic, this column is being published in the summer.

For this year’s edition, I’ll revisit how the trends highlighted last year fared and if they will continue to shape our year ahead, spotlight some things to watch in the last six months of 2023, and provide my perspective about the future of geospatial through the lens of the revised American Society for Photogrammetry and Remote Sensing (ASPRS) Accuracy Standards for Digital Geospatial Data, which are due to be published later this year.

Navigating recovery, gaining strength

Four months into 2023, the pandemic continues to impact the geospatial industry. In 2021 and 2022, supply chains and productivity were disrupted, leading to shortages of critical materials, parts, and products, some of which compromised vital survey hardware. However, our industry has shown resilience as many companies and manufacturers have implemented new workplace safety protocols, increased automation, and diversified supply chains to mitigate the impact of future disruptions. In addition, geospatial hardware manufacturers have continued to advance new and unique capabilities for data acquisition.

Digital twin: Last year, I shared how BIM and GIS provide the foundation for the digital twin, and how the nearly synonymous term of “metaverse” was gaining traction. Over the last year, the collective benefits and returns on investment for the digital twin have continued to expand. As the value of the digital twin is increasingly realized, demand for this technology will skyrocket. A digital twin is a digital replica of a physical environment, whether it is an asset, process, highway corridor, river, ocean, or even the Earth. This digital representation comprises the entire life cycle of the asset or the project, from the planning stage to design and construction, and continues through operating the asset—all in one place.

Since the digital twin mimics the real-world characteristics of the physical environment in real time, with the help of Internet of Things (IoT) sensors, a facility engineer can remotely observe the operational environment of a building to manage environmental controls, power consumption, air quality, fire alarm systems, etc. A city emergency response team can simulate disaster scenarios to identify evacuation routes and aid access through a digital twin, or a port authority can manage its assets and port operations, guiding incoming and outgoing ships through its navigation channel by way of precision navigation. This capability can save billions of dollars at commercial ports that have restricted visibility due to fog or other environmental conditions that can impede navigation.

Additionally, the smart city concept coupled with the IoT will continue to expand, generating a wealth of data and information that can be used for geospatial analysis through artificial intelligence. The digital twin concept is fertile ground for using AI tools to extract useful information and predict future trends and phenomena. Increasingly, software companies are providing platforms for building and hosting digital twins. Companies such as Microsoft, through its Azure digital twin platform, Bentley, Autodesk, and Esri have developed capabilities to support digital twin development.

Virtual collaboration rooms and mixed reality: Several technologies that support virtual collaboration and data visualization were spotlighted in 2022. Those platforms generate the need for 3D data while providing a new means of data modeling and interpretation. These include Microsoft Mesh and HoloLens 2; Bentley’s mixed reality platform, SYNCHRO XR; and the NVIDIA Omniverse platform. Demand for higher-resolution 3D geospatial data has grown rapidly in the past year. This will continue to fuel multiverses that interface to human factors through augmented and virtual reality, offering new possibilities for visualization, design, and analysis. This mixed reality tech trend will rotate upward as more applications of AR and VR are discovered and applied to support multiple industries.

Deep into miniaturized sensors: Smartphones continue to branch out geospatially, putting lidar capabilities in the hands of the masses while expanding opportunities for professional surveyors and mappers to conduct geospatial surveys on small projects. A sneak preview of smartphones coming out this year indicates that they will include even more advanced lidar systems. This underscores how sensor systems will continue to get smaller, more efficient, and more technologically advanced.

High-definition maps for autonomous driving: I made a plea last year for the geospatial industry to take the lead in creating and standardizing high-definition maps for a global road network in support of autonomous vehicles. Sadly, a year has passed, and the situation remains unaltered. This precision location data should include lane numbers, freeway exit lanes, pedestrian crosswalks, bridges, overpasses, tunnels, locations of traffic control devices, 3D trajectories for road edges and boundaries, etc., with accuracy to the centimeter level, meter-by-meter road grade, and road superelevation. Addressing this situation continues to be an immense opportunity for our industry and the future of safe autonomous transportation.

Traffic trails in Financial District, Hong Kong. The geospatial industry can advance the future of safe, autonomous transportation by standardizing high-definition maps for a global road network. Courtesy of Getty Images.

Rising drone demand: As predicted, lidar based on UASs took off in 2022 and will continue to rise, providing a healthy offering of new and affordable lidar. In 2021, growth was spurred by the DJI lidar system, Zenmuse L1, which provided high accuracy at lower cost. Today, while most affordable UAS-lidar systems are based on Livox laser technology, systems based on Hesai technology (or Hesai scanners) are gaining interest, having proved to be more robust and better suited for general survey, mapping, and inspection applications. An example of this is the RESEPI XT32 by Inertial Labs, which features a 360-degree field of view and 32 lasers. The manufacturer claims the RESEPI XT32 provides 1-centimeter accuracy.

For drones overall, the industry demand is strong, especially for mapping and inspection applications.

Whirl around the coastal regions: Coastal wind energy contracts were highlighted in my article last year as part of a larger effort by the U.S. to transition to cleaner, renewable sources of energy and reduce reliance on fossil fuels. In 2022 and into 2023, this effort continues to grow, with wind farms approved and constructed along the nation’s coastlines.

Data democratization: In the past year we witnessed an explosion in the demand for high-resolution, high-frequency geospatial information from denser point clouds to more crowd-sourced location data. New market entrants are using AI to extract infrastructure features in exquisite detail. The market is hungry for good, raw 3D data to feed these algorithms. With the higher demand for geospatial data, we should see prices fall and higher shelf-life decrease. The quality and availability of publicly available data will also increase.

AI and the cloud: AI and machine learning both play a significant role in geospatial analysis and mapping. Thanks to private sector investments, cloud data hosting and processing, serverless cloud computing, off-the-shelf and open-source technologies, and streamlined workflows with AI tools all continue to trend upward. I am still hoping that federal and public funding can be used to entice further creativity in this field. Without these investments outside the private sector, the most cutting-edge geoanalytics will not be available to the broader market.

Lidar growth: As mentioned in multiple topics above, lidar continues to be a mover and a shaker for the geospatial industry and will remain so for the foreseeable future. Lidar efficiencies continue to expand across other industries to support robotic applications such as autonomous driving and machine learning.

Lidar continues to be a mover and a shaker for the geospatial industry and will remain so for the foreseeable future. Courtesy of Woolpert.

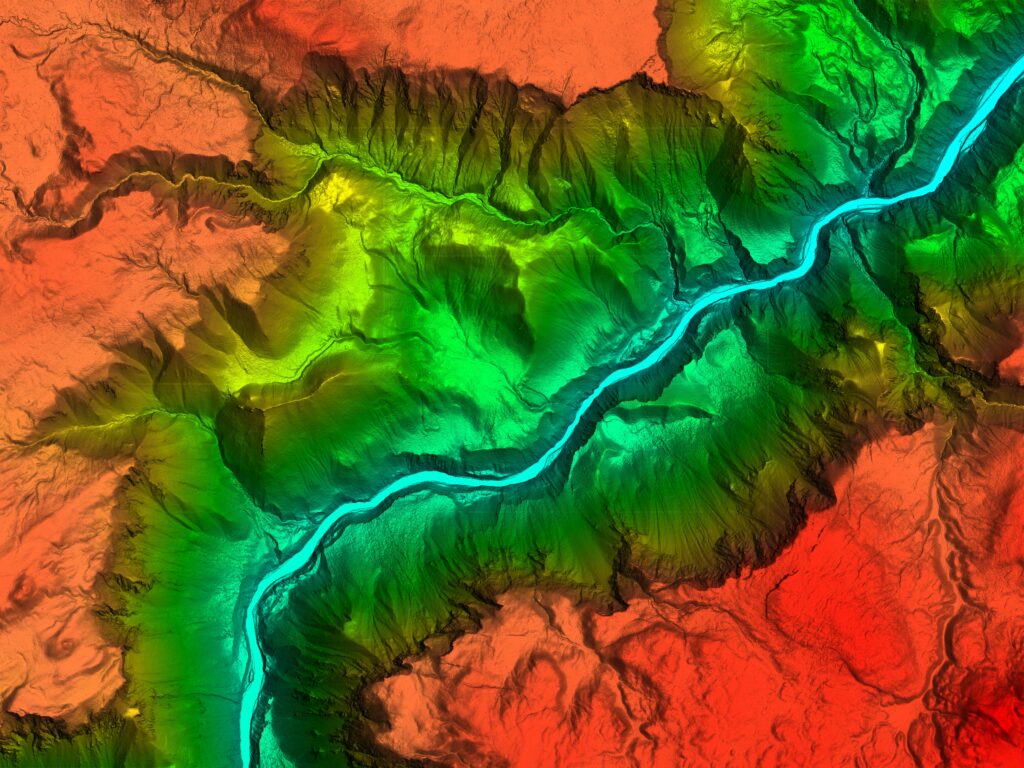

Woolpert collected lidar data of this Wyoming canyon in Yellowstone National Park to create a digital elevation model for the U.S. Geological Survey. Courtesy of USGS.

Bathymetric lidar has also been getting more attention. Leica recently announced the release of its newest deep bathymetric lidar sensor, the Leica HawkEye-5, which reportedly has a 25% increase in performance. Woolpert and the Joint Airborne Lidar Bathymetry Technical Center of Expertise (JALBTCX) announced Bathymetric Unmanned Littoral LiDar for Operational GEOINT (BULLDOG) technologies and sensor. These enable the collection of high-resolution topobathymetric data at a higher altitude, resulting in a broader swath than previously developed lidar systems.

The introduction of these new bathymetric lidar capabilities is timely, as they are being employed to serve the many vital statewide and national coastal mapping initiatives, as noted above with initiatives like FSMI. States are using this federal funding window to collect data essential to everything from asset management to infrastructure planning to disaster response. What is key to these opportunities is that contracting agencies make sure they collect consistent, high-quality data so they can reap the rewards of this funding for years to come. Miniature lidar manufacturing, especially for sensors mounted on drones, is getting a healthy share of the lidar market as more surveying and mapping businesses embrace the technology.

Other noteworthy trends

Here are a few other quick-hitting geospatial trends in technologies and methodologies to watch in 2023:

- Indoor mapping will continue to become more sophisticated, opening the door for improved indoor wayfinding and asset management.

- Location data will be subjected to increasing privacy and security regulations and standards. For the extra layer of security it provides, we may witness increased use of blockchain technology in geospatial data management and sharing.

- With more user-friendly data visualization tools available to all industries, 3D geospatial data will be increasingly used in training, gaming, planning, design, asset management, navigation, and other applications.

ASPRS Accuracy Standards update

When we published the ASPRS Positional Accuracy Standards for Digital Geospatial Data in 2014, we knew we would have to modify it based on user experience and feedback. Sure enough, after eight years of fast-changing sensor technologies and evolving applications, it became clear that significant changes needed to be made to the standards to make them more adaptable to today’s mapping practices.

One of the most important changes that our revision working group has endorsed is easing the accuracy of field surveying requirements for ground control and checkpoints. As we generate more accurate products, we have realized that the current accuracy requirement for checkpoints of three times better than the accuracy of the tested product has rendered nearly useless the affordable RTK-GPS techniques that are predominately used for surveying. This requirement has forced contracting agencies to specify more expensive surveying techniques, which has proved to be cost-prohibitive for completing these contracts.

Another important change is the addition of five addenda on best practices and guidelines in project notes and data reporting, photogrammetry, lidar, UAS, and field surveying. When we published the first edition in 2014, we designed it to be a modular standard to accommodate additional materials as the industry evolved. Since then, we have witnessed an unprecedented acceleration in geospatial technologies and practices. This growth necessitated guidelines and best practices in multiple aspects of geospatial mapping to help users of the standards navigate these rapidly changing advances. These addenda were crafted by industry leaders who specialize in these fields.

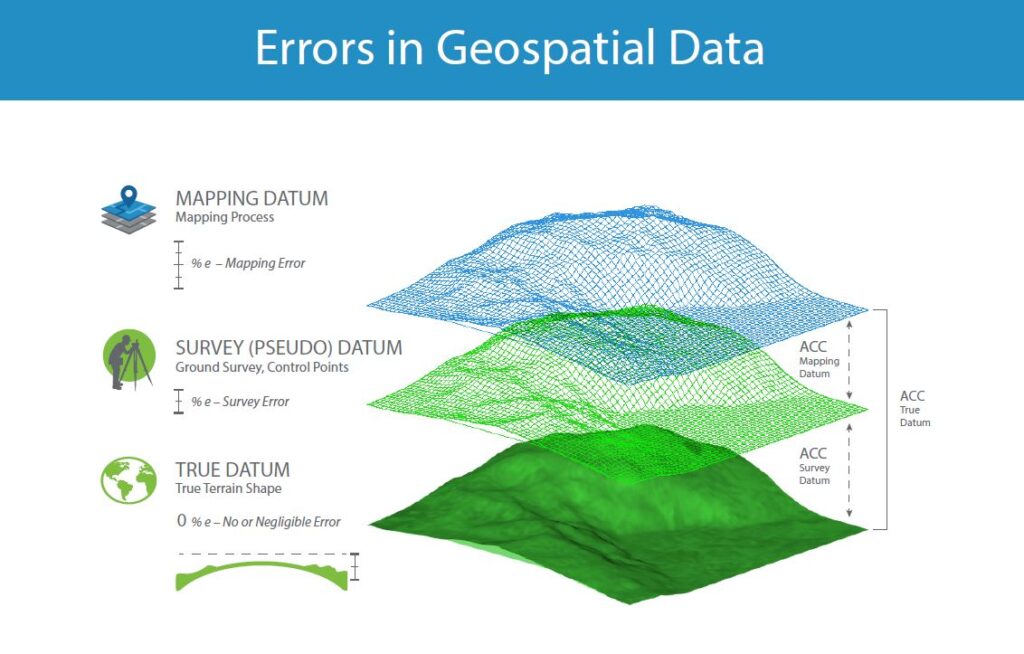

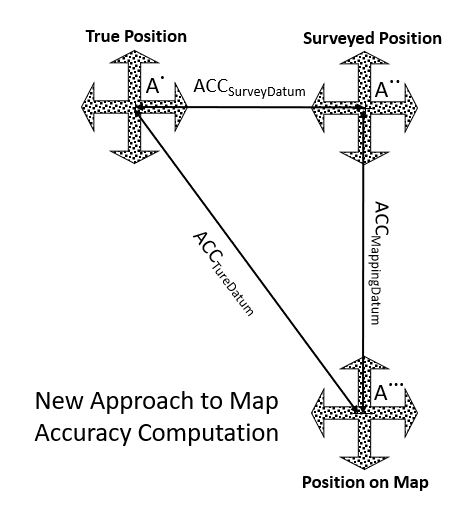

In addition, an important change is coming regarding the way we evaluate product accuracy. Currently, we ignore the error in survey checkpoints. That practice was acceptable when geospatial mapping product accuracy was low, and the surveying techniques applied did not represent a substantial enough source of error to be considered in computing product accuracy. As we are moving into more accurate products, i.e. in the range of a few centimeters, it has become apparent that the 2 cm error embedded in the RTK-GPS survey technique can no longer be ignored. The new method will consider the fit of the product to the checkpoints plus the error of the survey.

Some of the ideas underlying the second edition of the ASPRS Positional Accuracy Standards for Digital Geospatial Data

The second edition of these standards will be published in the next few months. A forthcoming article will highlight the changes and their ramifications which are designed to advance the geospatial industry. Above all else, this will have a long-lasting impact on the geospatial industry.

Note: This article is running in both Photogrammetric Engineering & Remote Sensing and LIDAR Magazine.