Key Takeaways:

• Yole expects 3.2% of personal cars to adopt lidar technology by 2025

• The covid-19 crisis has placed pressure on the automotive segment

• Emission requirements have shifted investments toward electrification

Editor’s Note: Just how big are the “lidar markets”? Each Year, the French firm Yole publishes an exhaustive review of activities across various industries. Previous estimates of a 2024 marketplace as large as $6 billion (USD) have been revised downward.

Lyon, France – “The price drop in lidar in the past three years has been massive,” asserts Pierrick Boulay, Technology & Market Analyst, at Yole Développement (Yole). “Indeed, it is the result of strategies by different companies and not due to the result of mass-production. Volumes have not evolved significantly in these three years and mass adoption of lidar still has to happen. However, this price drop of lidar has a significant impact on market forecast. At Yole, we expect that the unit price of lidar will continue to decline, and large volumes will be needed in order to maintain the market.”

Lyon, France – “The price drop in lidar in the past three years has been massive,” asserts Pierrick Boulay, Technology & Market Analyst, at Yole Développement (Yole). “Indeed, it is the result of strategies by different companies and not due to the result of mass-production. Volumes have not evolved significantly in these three years and mass adoption of lidar still has to happen. However, this price drop of lidar has a significant impact on market forecast. At Yole, we expect that the unit price of lidar will continue to decline, and large volumes will be needed in order to maintain the market.”

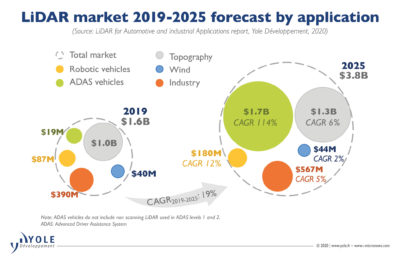

In this complex and rapidly evolving environment, Yole’s analysts predict that the lidar market for automotive and industrial applications will be US$1.7 billion in 2020. Growth is expected to be 19%. Yole’s forecast is a revenue of US$3.8 billion in 2025. Automotive applications are expected to be the main driver for lidar in the next five years, providing US$1.8 billion growth between 2019 and 2025. Yole expects 3.2% of personal cars to adopt lidar by 2025. On the other hand, the impact of robotic cars on lidar will be more modest due to lower deployment of robotic cars than once expected. lidar for personal cars could also be jeopardized.

The covid-19 crisis is putting financial pressure on car manufacturers. Regulations imposing reduced carbon emissions are pushing investments toward electrification. Finally, the ambition of Tesla to rapidly achieve autonomous cars without lidar could make lidar less essential in the coming years.

Alexis Debray, PhD., Technology & Market Analyst, MEMS, Sensors & Photonics at Yole asserts: “A new trend in the lidar business appeared a few years ago, which might dramatically change the shape of the lidar market, namely dropping prices. Velodyne has announced a plan to reach an average unit price of US$600 by 2024, from US$17,900 in 2017”. And the story does not stop here. Indeed, Chinese lidar companies, which usually have lidar unit prices one-fifth of that of other companies and usually below US$1,000, are gaining market share and expanding their business. lidar with lower unit prices is expected to enter new industrial applications, including factory, logistics and security.

For more information, visit: http://bit.ly/Yole-Report-2020

A PDF of this article as it appeared in the magazine is available here.